- Similar business ideas:

What is outdoor trading? What are the rules for organizing trade in goods on the pedestrian zone? Reading in this article...

Characteristics of outdoor trading (street trading)

The sale of goods outdoors, non-stationary trade, trade “from wheels” and trailers, from stalls and tents in specially designated areas is called “street trade” in a different way. It is worth noting that we are not talking about street trading with the sale of goods in specialized food markets, where “ordinary pensioners” sell products from their personal subsidiary plots (onions, potatoes, tomatoes, etc.). Local authorities turn a blind eye to such trade, and no one will touch grandmothers. Another thing is if a private person with his tent stood somewhere in the center of the city or on the roadway, without any permits and approvals, and sells anything. For example, there is a widespread method of illegal street trading, in which vegetables and fruits are purchased at wholesale depots, and then resold directly on sidewalks and roadsides without any sanitation standards.

Therefore, I propose to study this issue from the point of view of the law. What will happen if you organize trade according to a simple principle - “I took any product, stood anywhere and trade as much as I want”? Let's analyze the points: - According to the Code of Administrative Offenses of the Russian Federation, Art. 14.1, carrying out business activities without state registration as an individual entrepreneur or a legal entity entails the imposition of an administrative fine in the amount of 500 to 2000 rubles; - According to the same code of the Russian Federation on administrative offenses, Art. 14.4, the sale of goods that do not meet the quality standards entails the imposition of an administrative fine on citizens in the amount of 1,000 to 2,000 rubles, on officials - from 3,000 to 10,000 rubles; for persons carrying out entrepreneurial activities without formation of a legal entity, - from 10,000 to 20,000 rubles; for legal entities - from 20,000 to 30,000 rubles; - The rules for organizing outdoor trade are present in the legislation of the constituent entities of the Russian Federation, therefore the amount of fines and administrative penalties for trading in unspecified places is regulated by local laws. Usually the penalty for trading in an unspecified place is from 500 to 1500 rubles.

Why do the authorities dislike "chaotic" trading on the street so much? Yes, because it poses a threat to the sanitary and epidemiological well-being of the population, fire and road safety.

Moreover, many entrepreneurs who legally organized their business really do not like street "illegals" who set up their stalls near them without any approval from the administration. And, often, it is precisely at the call of private entrepreneurs and businessmen that this chaos of illegal street trading is at least somehow controlled.

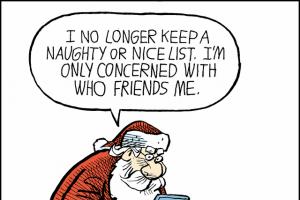

A good alternative to street trading is online trading. For this, it is not necessary to open an online store. You can create your own VK group, for example, or use message boards such as Avito. If you know how to organize trade, you can get stable income on bulletin boards.

Bodies controlling trade on the street

The main regulatory bodies that oversee compliance with the rules of outdoor trade are the local administration, Rospotrebnadzor (SES), tax and police authorities. Compilation of protocols for violation of the rules of street trading can be carried out by Rospotrebnadzor and police officers, and for illegal business activities - tax.

For a more detailed study of the rules for conducting inspections by regulatory authorities, we advise you to read the Federal Law of December 26, 2008 N 294-ФЗ “On the Protection of the Rights of Legal Entities and Individual Entrepreneurs in the Implementation of State Control (Supervision) and Municipal Control”.

Which taxation system to choose

1. Register as individual entrepreneur(IP) or a legal entity (LLC) in the Federal Tax Service (tax), since it is not possible for a private person to obtain a permit for street trading. Tax regime - UTII or USN;

2. Registration with the PFR (pension fund) and the FSS (social insurance fund) as an employer if you plan to hire sellers; 3. Submission of an application to the trade department of the local administration for obtaining a permit for traveling or street trading. As a rule, the following documents will be required to be attached to the application:

- Location plan (or map) of a mobile object;

- A copy of the certificate of state registration as an individual entrepreneur or legal entity;

- A copy of the certificate of registration with the tax authority;

- A copy of the charter for legal entities;

- A copy of the identity document of the applicant;

- A certificate from the tax office stating that there are no debts to the budget for tax payments.

It should be noted that permission can only be obtained in certain places, according to the territorial plan for the placement of non-stationary retail facilities, and not where you want. This plan is approved by the local administration.6. Start of trading activity. Do not forget that when selling food products, all established norms must be observed, for example, sellers must have sanitary books. And if you plan to sell meat, then also a veterinary certificate of Form No. 2 for products.

How much can you earn from street trading

- The sale of chicken eggs has a 100% profitability. When selling 100 eggs a day, you can get more than 500 rubles. net profit.

- The markup on vegetables and fruits is over 150%. By selling rare and expensive vegetables (asparagus, arugula, salads, etc.), you can earn over 400 thousand rubles per season. with 15 acres of land.

- Opening a point for the sale of honey rightfully considered a profitable business. Honey is very useful, has excellent taste and practically does not deteriorate.

To get a high income from street trading, you need to correctly determine the cost of products. To do this, you will need to evaluate your time and add the price to the money spent. If a self-produced or grown product is used, it is necessary to determine how much time will be spent on production and on sale. The markup on goods depends on demand and seasonality. For example, a bunch of fresh herbs or a kilogram of carrots in early spring will cost much more than in summer, homemade eggs will bring several times more income in winter

How much money do you need to run a business

Street trading can be organized without initial capital, one has only to sell vegetables grown by oneself, berries and fruits. To sell products you will need:

- Disposable plastic containers - from 2 rubles apiece;

- Small table - from 500 rubles. (can be made by yourself)

When selling other goods, funds will be required to purchase them. A certain amount is needed to start almost any business. Having a small capital, it is very profitable to do investments in new buildings. If you approach investing wisely, then it will not require large investments.

How to choose business equipment

A table or a rack can be made independently from natural wood. You can also purchase inventory made of artificial materials.

Which OKVED to choose during registration

- 12 - other retail trade in non-specialized stores;

- 33 - retail trade in cosmetics and means, perfumery;

- 62 - retail trade in a tent, market;

- 63 - other retail trade;

What documents are needed to open a business

To obtain a street trading permit, you must provide:

- IP registration certificate.

- Sanitary and epidemiological conclusion in the food trade.

- The list of products agreed with the SES.

Do I need a permit for street trading?

When trading on the "spontaneous market" goods that do not require licensing, additional permits are not required.

Illegal trade - illegal sale of goods with the absence of a formalized status of an entrepreneur. The most common type of illegal trade is unauthorized street trading in places with high traffic of people.

One of the popular places for trading in Moscow is metro entrances, passages, busy streets. Illegal trading on the street entails an administrative penalty in the form of a fine. In addition, all unlicensed goods will be confiscated. The maximum punishment that can overtake sellers is arrest, lasting up to six months.

Fine for unauthorized street trading in Moscow

Trading in unspecified places without violating the law is possible in two cases:

- sale of flowers in retail or small wholesale;

- sale of products of own production during the fair.

But both cases require special permission from the administration, which controls the trading area where business activities are carried out. Fairs are strictly regulated by the city administration.

Trade is considered illegal in the following cases:

- product infringement of copyright;

- distribution ban;

- harmfulness of the goods;

- propaganda of discrimination;

- sale of goods without a license.

The penalty for illegal trading varies depending on the type of violation:

- for the lack of registration of an entrepreneur or organization, a fine in the amount of up to 2 thousand rubles will be imposed;

- for the absence of the necessary documents, licenses or permits, the fine for an individual will be equal to 2.5 thousand rubles, for an official - 5 thousand, for an organization - 50 thousand.

Fine - administrative responsibility. In addition to it, tax liability or criminal liability may be assigned. The Criminal Code of the Russian Federation comes into force for punishment when the profit of the outlet exceeds 1.5 million rubles.

Currently, there are several reasons why illegal trade is still common on the streets. First of all, the actions of the police do not have the desired effect on the sellers. The population itself considers retail outlets to be more profitable than chain stores, since they set low prices and are located in accessible places.

On the legality of the organization of trade, you can get advice from experienced professionals from the Right Solution Company - this will help you properly organize your further actions.

Permit for street trading

Street trading includes the sale of goods outside the territory of shopping centers and shops. The most common street vendors are cars and caravans, as well as tents. In order to trade legally, it is necessary to register an individual entrepreneurship or a legal entity. Registration is carried out in the tax authority. Failure to register with the tax service entails a fine of 10% of income, but not less than 40 thousand.

The procedure for obtaining a permit for street trading is regulated by certain provisions in the legislative documents of the Russian Federation. Responsibility for ignoring this procedure is established by the Code of Administrative Offenses of the Russian Federation.

In order to obtain a permit, it is necessary to prepare documents in stages. Initially, the supervisory services are notified of the intention to conduct street trading. Next, you should prepare an application and send it to the local government. The last stage is the coordination of trade with the sanitary and epidemiological service.

It is important to obtain all permits in advance in order to engage in trading activities and avoid fines. Preparation of documents and further transfer can take place both personally and with the help of representatives. Contacting the Legal Solution Company will eliminate possible problems in the process of obtaining a permit, as the specialists have extensive experience in obtaining permits.

Consider what is fraught with trade without registering an IP: fines, liability, penalties.

Sometimes people think about closing an IP and working illegally or not opening an IP at all initially. This is due to an increase in the amount of insurance payments to the Pension Fund and the Medical Insurance Fund and the unwillingness to pay taxes. Will it be possible to save money in this way or will the fines be much higher and the risk will not be justified?

For trading without an individual entrepreneur, several types of punishments can be applied at once - administrative, criminal and tax. Each case has its own procedures, means of fixing the offense and the level of responsibility. First, it is worth deciding on the very concept of entrepreneurship and how to separate such activities from other types and how to prove the fact of its conduct.

The concept and essence of entrepreneurial activity

The Civil Code of the Russian Federation unambiguously defines the essence of entrepreneurial activity, meaning by it actions aimed at systematic profit.

The Civil Code of the Russian Federation unambiguously defines the essence of entrepreneurial activity, meaning by it actions aimed at systematic profit.

Profit may be the result of trading activities, the provision of services or the implementation of any kind of work.

In the same code there is a clause obliging citizens to register as an individual entrepreneur in advance of the start of business activities.

It is worth emphasizing that it is precisely such a definition in the law that leads to difficulties in cases where it is necessary to prove the fact of illegal conduct of activities.

This is due to the fact that it will be necessary to prove the systematic nature of the same kind of activity and the presence of a constant profit.

Systematic means when a person conducts any individual activity more than twice a year. The single fact of the sale of goods or the provision of services does not indicate the implementation of activities of an entrepreneurial nature.

In general, illegal trade refers to a number of aspects:

- illegal goods and services;

- copyright infringement;

- goods and services that have the character of any kind of discrimination;

- lack of necessary permission to sell goods subject to licensing;

- lack of registration as an individual entrepreneur when trading;

- violation of people's moral values.

There are activities for which the law does not oblige citizens to register as an entrepreneur. Such activity, among others, is the sale of flowers on the market. To engage in such trade, an agreement with the market administration is enough.

Citizens who do not have registration as an individual entrepreneur and are engaged in entrepreneurship face not only a fine. Responsibility can be criminal, up to restriction of freedom. The fact of conducting this kind of activity must be proved, but if it is revealed, the consequences can be extremely serious.

Administrative responsibility

According to the Administrative Code of the Russian Federation, for trading without an individual entrepreneur, a penalty is provided in the amount of 500 to 2000 rubles. It is the justices of the peace who decide on the application of such liability. The case is considered either at the place where the offense was committed, or at the request of the citizen at the place of his registration.

The basis for judicial proceedings is the initiation of administrative prosecution through the preparation of a protocol. Such a protocol can be drawn up by a police representative, an employee of the tax inspectorate, an employee of the inspectorate for trade or an antimonopoly policy body, an employee of the prosecutor's office, which is fixed in the Law.

The basis for judicial proceedings is the initiation of administrative prosecution through the preparation of a protocol. Such a protocol can be drawn up by a police representative, an employee of the tax inspectorate, an employee of the inspectorate for trade or an antimonopoly policy body, an employee of the prosecutor's office, which is fixed in the Law.

In order to draw up a protocol on an administrative offense, employees of the authorized bodies must check the trading premises or make a test purchase in order to prove the fact that the activity without registration of the individual entrepreneur actually took place.

Court proceedings are initiated only if no more than two months have elapsed from the moment the protocol was drawn up until the case was submitted to the court. In practice, protocols are drawn up by employees with errors, which causes the protocol to be returned to the department that compiled it for the elimination of shortcomings. In the case when the department does not have time to return the case to the court in a corrected form before the expiration of two months from the moment the protocol was drawn up, the prosecution is terminated.

Criminal liability

Business without registering an individual entrepreneur can also be punished from the point of view of the Criminal Code of the Russian Federation. Paragraph 171 provides for punishment for illegal receipt of income from activities in excess of 250,000 rubles. Punishment is also provided for those who cause major damage to individuals, organizations, or even the entire country.

If there is evidence that a citizen illegally received income in excess of 250,000 rubles, criminal liability is provided in the form of a fine of 300,000 rubles, arrest for 6 months or corrective labor for up to 240 hours. It is quite difficult to prove such high returns in a simple test purchase. Such cases, as a rule, are connected with the legalization of illegally obtained income and money laundering.

If there is evidence that a citizen illegally received income in excess of 250,000 rubles, criminal liability is provided in the form of a fine of 300,000 rubles, arrest for 6 months or corrective labor for up to 240 hours. It is quite difficult to prove such high returns in a simple test purchase. Such cases, as a rule, are connected with the legalization of illegally obtained income and money laundering.

In case of causing harm or receiving illegal profit on an especially large scale, the penalty varies from 100,000 to 500,000 rubles. The convict may also face imprisonment for up to 5 years with a simultaneous fine of 80,000 rubles. An especially large amount is understood as illegal income amounting to more than 1,000,000 rubles.

The punishment depends on whether a citizen is first involved in this offense or not, whether he has positive characteristics. In the presence of positive characteristics and good public behavior, a citizen receives a fine without imprisonment. The Supreme Court of the Russian Federation clarified that paragraph 171 of the Criminal Code of the Russian Federation does not apply to owners of residential premises that rent them out. Such activity without registering an individual entrepreneur is not subject to criminal prosecution, regardless of the amount of rent charged.

Tax Liability

Activity without registration entails tax liability, indicated in two paragraphs of the Tax Code of the Russian Federation - 116 and 117. The second provides for punishment for the lack of registration in the form of a fine of 10% of the estimated income, but this amount cannot be less than 20,000 rubles . According to paragraph 117, when unrecorded activities exist for more than three months, the fine increases to 20% of unrecorded income, however, such a fine will be at least 40,000 rubles. According to paragraph 116, if the deadlines for tax registration are not met, a fine of 5,000 rubles is provided. In the case when the violation of the terms is more than three calendar months, the amount of the penalty increases to 10,000 rubles. However, punishment can only be applied on one of the two counts.

Activity without registration entails tax liability, indicated in two paragraphs of the Tax Code of the Russian Federation - 116 and 117. The second provides for punishment for the lack of registration in the form of a fine of 10% of the estimated income, but this amount cannot be less than 20,000 rubles . According to paragraph 117, when unrecorded activities exist for more than three months, the fine increases to 20% of unrecorded income, however, such a fine will be at least 40,000 rubles. According to paragraph 116, if the deadlines for tax registration are not met, a fine of 5,000 rubles is provided. In the case when the violation of the terms is more than three calendar months, the amount of the penalty increases to 10,000 rubles. However, punishment can only be applied on one of the two counts.

According to the Tax Code of the Russian Federation, the obligation to register with the tax office falls on the citizen before the start of making a profit from the activity. The moment of delay in this case will be considered the fact of the presence of the first profit. This state of affairs leads to the application of paragraph 117 of the Code. In the event that a citizen submitted an application for registration before the time of the audit, but received proceeds before registration with the tax authority, clause 116 applies.

If a citizen is held liable for the lack of registration with the tax authority, inspectors have the right to assess taxes and contributions to the budget, for which late penalties can be calculated. Penalty for late payment of taxes equals 20% of the amount of taxes assessed and will be presented together with taxes.

In any case, the fine is paid only if there is a court decision that has entered into force. Cases are heard in general courts. The drawn up protocol still does not oblige the person in respect of whom the check was carried out.

The official registration of a business entails such a pile of obligations and payments that some enterprising novice businessmen are wondering - what will happen if they trade without an individual entrepreneur? Is it possible to conduct entrepreneurial activity without going through the registration procedure with the tax authorities? In fact, this can entail quite serious consequences, and in order to warn those who want to save money and make their lives easier, we will consider this issue in more detail.

About registration

Any commercial activity aimed at making a profit must be registered. Even if you just knit gloves and sell them, sitting on a bench at the entrance. Even if you rent out your second garage to a neighbor. You may remember how you recently fought against the rental of private property and tried to bring this activity out of the shadows: to force private landlords to register their rental activities. And many were forced to rent apartments officially: open individual entrepreneurs, conclude an agreement with tenants and pay taxes.

The state functions thanks to taxes. Taxes are levied on almost all working citizens and sent to the country's budget to cover the costs of building roads, providing free education and medical care, defense, and the like. The very idea is this - by transferring taxes, we provide ourselves with various benefits from the state. When the state receives less taxes, it reduces its spending. And, above all, it is the social sphere that suffers - schools, hospitals and kindergartens.

That is why the supervisory authorities strictly monitor the legality of commercial activities. Working and trading without registering an individual entrepreneur or LLC is fraught with serious consequences - fines and even imprisonment.

Consequences of activity without registration

Opening an illegal outlet or any other commercial activity without state registration falls under the articles of three codes at once - Administrative, Tax and Criminal.

Let's start with administrative responsibility. The activity of an entrepreneur without official registration with the relevant state body falls under the wording of Article 14.1 of the Code of Administrative Offenses. Illegal trade under this article is punishable by a fine in the amount of 0.5 to 2 thousand rubles.

If administrative responsibility may seem ridiculous to you, then the Tax Code takes the issue of working without registration much more seriously! Article 116 of the Tax Code of the Russian Federation implies a fine of ten thousand rubles in case of violation of the deadline for filing an application for registration - this is if you are simply late with the necessary document to run to the tax office, but have already started working. And if you have been working without registration for a long time, tax inspectors will find out how long you have been doing this, using a special method, they will suggest how much income you could have received during this time (perhaps you only dream of such income) and take 10% of this amount from you . At the same time, the fine has a lower limit - if 10% of the estimated income turns out to be less than forty thousand rubles, you will have to pay these forty thousand. In addition, the inspector has the right to charge additional taxes and penalties for their non-payment on the estimated income, as well as fine you for not submitting tax returns.

In addition, the Criminal Code has a separate article 171, which imposes punishment for engaging in illegal commercial activities. The first paragraph of this article comes into force if your illegal business has caused significant damage to other citizens, legal entities or the state itself, or you have managed to earn a large amount of income (according to the law - over 1.5 million rubles). In this case, the fine can be up to 300 thousand rubles, or you will be deprived of the amount of your income or salary for two years. Also, an illegal entrepreneur can be arrested for six months, or sent to compulsory work for up to 480 hours.

If you were engaged in illegal activities not alone, but with a partner or friends, you may be called an organized group, and then you will fall under the second paragraph of the article, under which the sanctions are even stricter. The same threatens you if, in the course of your unregistered activities, you were able to receive income on a particularly large scale - over 6 million rubles. So, the fine under the second paragraph of this article will be from 100 to 500 thousand rubles, or in the amount of the income or salary of the perpetrator for a period of 1 to 3 years, compulsory work will stretch for up to 5 years. And they can also award imprisonment for up to 5 years and a fine of up to 80 thousand rubles, or in the amount of income for six months. They can do without a fine - just plant them.

These are the consequences that a desire to trade without registering an individual entrepreneur or legal entity may entail. Of course, the fact of illegal activities must still be confirmed, however, tax inspectors and other representatives of regulatory authorities, if they wish, will be able to find the evidence they need. Working without registration, you can get into a fairly serious turnover. So register, choose tax systems that are convenient and beneficial for you, and save on payments better with their help - since our Tax Code provides entrepreneurs with such an opportunity.

Mezentseva Vasilisa

Specialists of the district council, on a daily basis, together with the internal affairs bodies and representatives of the OBOR, monitor the territory, including using city video surveillance systems, to identify violations and suppress unauthorized actions related to illegal trade.

Also, specialists of the council systematically carry out explanatory work with the population on the prevention of violations and on administrative responsibility in trade and the provision of services in unidentified places.

Dear residents of Moscow and guests of the capital!

Hand trading is not only a direct violation of the law, but also becomes a prerequisite for other offenses.

Unsanitary conditions flourish in places where illegal traders accumulate, and there is a high probability of purchasing low-quality products, health problems, and deceit.

Department of Trade and Services of the City of Moscow warns of the dangers of unauthorized trade and urges you to be careful when making purchases.

Be careful, take care of your health and the health of your loved ones!

The issue of preventing and suppressing unauthorized trade in the territory of the Shchukino region is under constant control.

Pensioners, migrants, people engaged in illegal business activities sell home-cooked food, greens, seasonal vegetables and fruits, consumer goods, flowers, Muscovites can see every day near metro stations when they go to or from work. Many turn a blind eye to this - it is obvious that pensioners are standing in the cold and in the heat with their modest goods, not from a good life. At the same time, unauthorized trade is a negative social phenomenon that causes considerable harm to the residents of the city.

The first thing that catches your eye is the appearance that unauthorized trade imposes on the city, since it is carried out using improvised means - boxes, wooden boxes, which, as a rule, are obtained from garbage containers, folding tables, exhibited on routes with high passenger traffic, often trade is carried out directly from the ground.

Secondly, such trade is dangerous for the health and even life of buyers, as it is carried out without observing even elementary sanitary standards. Traders do not have documents confirming the safety of food and industrial goods, as well as sanitary books confirming their health. There were precedents for people suffering from tuberculosis to trade in food. Dairy products (cottage cheese, sour cream, milk), pickles, as a rule, are not packaged, free for the penetration of insects and their metabolic products. Everyone can verify this. Of course, such products are dangerous in relation to the spread of acute intestinal infections. Using them, you can get diseases such as dysentery, salmonellosis, food poisoning.

Third - in spite of the seeming spontaneity of hand trade, it is often streamlined and well organized from the inside. So, behind a modest grandmother who sells knitted hats or flowers near the metro, there may be wholesale suppliers who have put such trade on stream. Similar facts were also revealed by specialists of the district council.

The fight against unauthorized trade is carried out by specialists of the district administration on a daily basis. Specialists of the district council at least twice a day carry out raids on the territory of the district in order to identify places of accumulation of unauthorized trade. Persons trading from their hands are warned about the unlawfulness of their actions, in case of their refusal to stop trading, police squads are called, and protocols on administrative offenses are drawn up against violators. All information about the places of conducting unauthorized trade in the district is promptly transferred to the officers of the internal affairs department of the Shchukino district. In order to improve the effectiveness of combating unauthorized trade in the district, a mobile group is operating to combat unauthorized trade, consisting of responsible officers of the Shchukino district police department and specialists from the district council.

On the territory of the Shchukino district, on an ongoing basis, work to suppress unauthorized trade is carried out by employees of the internal affairs department for the Shchukino district, representatives of the Public Point for the Protection of the Order of the Shchukino district and the Volunteer People's Druzhina of the Shchukino district.

According to Government Decree No. 806-PP dated December 10, 2013 "On measures to prevent unauthorized trade in crowded places in the city of Moscow", measures to control and monitor public gathering places, along with the already listed structural units, are being carried out :

- The state unitary enterprise of the city of Moscow "Mosgortrans" - within the boundaries of a 50-meter zone from the stopping points of urban public passenger transport.

- State unitary enterprise of the city of Moscow "Moscow Order of Lenin and the Order of the Red Banner of Labor Metro named after V.I. Lenin" - in the lobbies of metro stations and within the boundaries of a 50-meter zone from metro stations.

- The state budgetary institution of the city of Moscow for the operation and repair of engineering structures "Gormost" - in the under-bridge spaces, in underground pedestrian crossings, as well as within the 50-meter zone from the under-bridge spaces, underpasses.

- State government institution of the city of Moscow "Organizer of Transportation" - within the boundaries of transport hubs, as well as within the 50-meter zone from transport hubs.

- Department of Culture of the City of Moscow - on land plots, including those located within the boundaries of specially protected natural areas of the city of Moscow, provided for use by state cultural institutions of the city of Moscow - parks of culture and recreation, museums-estates and museums-reserves, the Moscow Zoo, the Moscow Association for museum and exhibition work "Museon", subordinated to the Department of Culture of the city of Moscow, as well as within the boundaries of pedestrian zones of citywide significance of the city of Moscow.

Unauthorized trade violates about 10 federal, regional laws:

- Article 11.1 of the Law of the City of Moscow dated November 21, 2007 N 45 "Code of the City of Moscow on Administrative Offenses".

- Article 14.1. Code of Administrative Offenses of the Russian Federation "Carrying out entrepreneurial activities without state registration or without a special permit (license)"

- Tax Code of the Russian Federation, Art. 45: tax evasion

- Migration legislation: since a significant part of persons engaged in unauthorized trade are stateless persons of the Russian Federation.

- Labor Code of the Russian Federation, Art. 214: lack of mandatory medical examinations

- Decree of the President of the Russian Federation No. No. 65 "On Free Trade": on the prevention of trade in unspecified places

- Law of the Russian Federation No. 4979-1 “On Veterinary Medicine”: on the prohibition of the sale of products of animal origin that have not been subjected to veterinary and sanitary examination in accordance with the established procedure.

- Federal Law "On the quality and safety of food products", art. 3, 20, 23: lack of documents confirming the origin and safety of products, conclusions of the state veterinary service; sellers do not undergo mandatory medical examinations and hygiene training, do not have medical books.

- Sanitary and epidemiological rules: violation of the rules of storage, commodity neighborhood, product sales, sanitary standards, general requirements for the organization of trade enterprises.

- Rules of the road, clause 12.4: violation of the parking rules, because Often, unauthorized traders use vehicles, and sometimes they themselves enter the road network at the peak of traffic congestion and offer goods to drivers.

Please support the city's anti-trafficking policy and do not buy hand-sold products of dubious quality. Remember, it can pose a risk to your health. If unauthorized trade is detected on the territory of the Shchukino district, for help, you must contact the nearest internal affairs officer or call the duty unit of the Internal Affairs Directorate, the telephone number of the internal affairs department of the Shchukino district, or 02. Department of Internal Affairs of the Shchukino district: 8 499 190-70-10