Decree of the State Statistics Committee of the Russian Federation of January 21, 2003 N 7 "On approval of unified forms of primary accounting documentation for accounting for fixed assets" contains forms primary documents, essential for correct design operations with fixed assets.

Accounting for fixed assets is carried out on the basis of the following primary documents:

· Act on the acceptance and transfer of fixed assets (except for buildings, structures);

· Act on the acceptance and transfer of groups of fixed assets (except for buildings, structures);

· Invoice for the internal movement of fixed assets;

· Act on the acceptance and delivery of repaired, reconstructed, modernized fixed assets;

Act on the write-off of fixed assets (except for cars Vehicle);

Inventory card for accounting of fixed assets, etc.

Receipt of fixed assets

The receipt of fixed assets is formalized by an act of acceptance and transfer of an object of fixed assets, which is drawn up and signed by a commission appointed by the head of the enterprise.

The acceptance document states:

Characteristics of the object of fixed assets;

its location;

year of manufacture or construction;

date of commissioning;

· test results, etc.

Simultaneous acceptance (posting) of the same type of tools, machines, household equipment, etc. objects having the same value can be drawn up in one act.

Each item of fixed assets accepted for accounting is assigned an inventory number. It is preserved during the entire period of operation of the object and is indicated on it (a token is attached, an inscription is made with paint, etc.).

It is not allowed to assign inventory numbers of decommissioned items of fixed assets to newly received items, as this can lead to errors in accounting.

The acceptance certificate is transferred to the accounting department, where an inventory card is created indicating the inventory number of the object and basic data about it (original or replacement cost, depreciation rates, depreciation at the time of acceptance).

Accounting for the availability and movement of fixed assets owned by the enterprise is carried out on account 01 "Fixed assets".

Account 01 "Fixed assets" reflects fixed assets at their original cost:

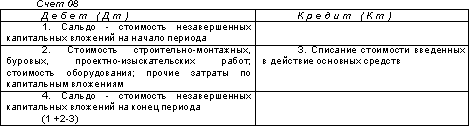

The cost of buildings, structures, equipment, vehicles and other individual items of fixed assets acquired by the enterprise is reflected using account 08 “Investments in non-current assets”. This account is used to reflect in accounting all the costs of the enterprise associated with the acquisition and commissioning of fixed assets, and thus performs the functions of a costing account. Analytical accounting on account 08 is maintained for each acquired or created object.

The inventory value of buildings, structures, equipment, vehicles and other individual fixed assets consists of the actual costs of their acquisition and the costs of bringing them to a state in which they are suitable for use for the planned purposes.

Fixed assets purchased for a fee from other enterprises and persons, as well as created at the enterprise itself, are reflected in the debit of account 01 “Fixed assets” and the credit of account 08 “Investments in non-current assets”.

Fixed assets received from other organizations and persons free of charge are reflected in the debit of account 08 and the credit of account 98 “Deferred income” at market value; when a fixed asset received free of charge is put into operation, its value is written off from the credit of account 08 to the debit of account 01 facilities". Depreciation for these fixed assets is accrued in the generally established manner, at the same time, debit 98 and credit 91 “Other income and expenses” are posted on the amount of accrued depreciation.

Acceptance for accounting of fixed assets contributed by the founders on account of their contributions to authorized capital, is reflected by posting debit 08 credit 75, then debit 01 credit 08.

When acquiring fixed assets from a foreign supplier (by import), the initial cost of fixed assets is recognized as the amount of actual costs for their acquisition. The costs incurred by the organization in foreign currency are reflected in the relevant accounts accounting in rubles at the exchange rate of the Central Bank of the Russian Federation on the date of the transaction. When accepting the received fixed asset for accounting, the resulting exchange differences are written off to account 91 “Other income and expenses”.

Under a lease agreement for fixed assets, the lessor undertakes to provide the lessee with property for a fee in temporary possession. The lessor takes into account the leased property on its balance sheet as part of its own fixed assets. The lessee accounts for property received for temporary use under a lease agreement on off-balance sheet account 001 "Leased fixed assets".

The enterprise can independently manufacture or construct fixed assets. In this case, the debit of account 08 “Investments in non-current assets” reflects all the actual costs of the enterprise associated with the creation of the object, namely: the cost of the materials used, wage employees and deductions to off-budget funds, the cost of work of third-party organizations, depreciation of fixed assets of the enterprise used to create a new item of fixed assets, other expenses. This way of creating fixed assets is called economic.

The organization may also conclude an agreement on the creation of fixed assets with a specialized organization. In this case, the debit of account 08 will reflect the cost of work performed in accordance with the contract. This method of creating fixed assets is called contracting.

When acquiring fixed assets, the buyer, in addition to the cost of the fixed asset, pays the seller the amount of value added tax. The amount of VAT on the acquisition of fixed assets is accounted for on b / c 19 sub-account "Value Added Tax on the acquisition of fixed assets". After the actual payment and in the presence of an invoice this amount VAT is debited from the credit b / c 19 -1 to the debit b / c 68 "Settlements with the budget".

Sub-account 19-1 "Value added tax on the acquisition of fixed assets", active:

Upon receipt of equipment requiring installation, its cost is reflected in the debit of account 07 "Equipment for installation" in correspondence with account 60 "Settlements with suppliers and contractors". The amount of VAT on the received equipment is reflected in the debit of account 19 "VAT" and the credit of account 60.

Installation of equipment is fixed by the presence of expenses in the certificate of the amount of work performed on the installation of this equipment, drawn up in the prescribed manner.

When carrying out construction and installation work in an economic way, the cost of the equipment transferred for installation is written off from the credit of account 07 to the debit of account 08.

Account 07 "Equipment for installation", active:

Your company has purchased equipment for the production of beer that requires installation. The contractual cost of the equipment was 21,000 rubles. plus VAT - 18%, included in the bill, amounted to 3780 rubles. Delivery services - 3000 rubles, plus VAT - 18%, included in the invoice - 540 rubles.

The cost of installing equipment on the account of the contractor amounted to 5,000 rubles. plus VAT (18% - 900 rubles)

The inventory value of the commissioned equipment amounted to 29,000 rubles (24,000 rubles + 5,000 rubles), and VAT - 5,220 rubles. (3,780 rubles + 540 rubles + 900 rubles)

What documents should be issued in the fixed assets accounting company (hereinafter referred to as OS). What documents reflect the movement of fixed assets (acceptance for accounting, transfer, transfer to another MOT, disposal). What tax risks can there be in the absence of these documents, if they are drawn up only in 1C (without printing). WELL.

The organization independently determines the moment of commissioning of fixed assets, however, temporary differences may arise, since depreciation in tax accounting is charged from the 1st day of the month following the month in which the property was put into operation. And in accounting, depreciation must be charged starting from the month following the one in which the property was accepted for accounting as a fixed asset.

- Tax and accounting changes in 2017

- Since 2017, a lot has changed in the work of accountants. Read about the latest changes in this section.

- Approved new CBC for insurance premiums and simplified

- The rules for filling in field 101 in the payment order have changed.

- Insurance premiums were transferred to the tax authorities.

- New reporting has appeared - calculation of insurance premiums, SZV-STAZH and others.

- In a new way, now you need to confirm.

- I want to be aware of all the changes >>

Answered by Lyubov Kotova,

Head of the Division for Regulatory and Legal Regulation of Insurance Contributions of the Tax and Customs Policy Department of the Ministry of Finance of Russia

"Now on title page calculation, there are fields “OKVED code”, “Number of working disabled people”, “Number of workers employed in work with harmful and dangerous factors”. Previously, you indicated this data in section II. IN new form there is no section I or section II of the report. Instead, there are six tables. How to fill them? Read the recommendation. There you will also find finished example calculation."

By general rule, to formalize the acceptance or sale of a fixed asset, an act of acceptance and transfer of the fixed asset in the OS-1 form will be required. For internal movement, an invoice in the form of OS-2 is required. The order of filling out the forms is given below.

The rationale for this position is given below in the materials of the Glavbukh System

Documenting

After examining the received property, the commission must give an opinion on the possibility of its use. Such a mark is put, making out the acquired property, in the act of acceptance and transfer of the fixed asset. Compile this document on the basis of standard forms or independently developed ones, the main thing is that they have all the necessary details.

There are different standard forms of acceptance and transfer certificates for fixed assets: *

- Form No. OS-1;

- form No. OS-1b;

- for one building or structure - form No. OS-1a.

Whatever form you use - standard or independently developed, the manager must approve it in the order.

The supplier accounted for the property being sold as a commodity. In this case, the act of acceptance and transfer is only the buyer, that is, you. Draw up an act on the basis of shipping and technical documents attached to the fixed asset. For example, a consignment note, object passports and user instructions. At the same time, do not fill in the details of the supplier, which are provided at the beginning of the act, as well as the sections “Information on the status of the fixed asset as of the date of transfer” and “Handed over”. After all, the supplier does not transfer the fixed asset when selling such property. Therefore, he is not required to draw up an act of acceptance and transfer of fixed assets. This is stated in the letter of Rosstat dated March 31, 2005 No. 01-02-09 / 205.

For any of the above options, the acceptance certificate must indicate: *

- number and date of drawing up the act;

- full name of the fixed asset according to the technical documentation;

- name of the manufacturer;

- place of acceptance of the fixed asset;

- factory and assigned inventory number of the fixed asset;

- depreciation group number and term beneficial use object of fixed assets;

- content information precious metals, stones;

- other characteristics of the asset.

The executed act is approved by the head of the organization, the entrepreneur or a specially authorized employee.

Simultaneously with the preparation of the act of acceptance and transfer for each object or group of homogeneous objects, fill out an inventory card or inventory book, however, the latter is intended only for small businesses. This can be done using forms No. OS-6, OS-6a, OS-6b or a self-developed form. Fill out these documents in one copy on the basis of the data of the act and accompanying documents, for example, technical data sheets. In the future, in the inventory card or book, enter information about all changes that affect the accounting of the fixed asset. Such as revaluation, modernization, internal relocation, disposal.

Sergei Razgulin,

This procedure is provided for in the instructions approved by the Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7. *

Sergei Razgulin,

Acting State Councilor of the Russian Federation, 3rd class

Documenting

Document the sale of fixed assets with standard documents or use independently developed forms. In the latter case, the main thing is that the forms contain all the necessary details. Whatever form you use - standard or independently developed, the manager must approve it.

There are different standard forms of acceptance and transfer certificates for the sale of fixed assets: *

- for one object, except for buildings and structures, - form No. OS-1;

- for several homogeneous objects, except for buildings and structures, - form No. OS-1b;

- for a building or structure - form No. OS-1a.

As a general rule, acts must be drawn up on the date when the ownership of the property passes from the seller to the buyer. Usually, by default, this happens on the day of shipment, unless otherwise provided in the delivery contract. An exception is provided only for buildings or structures. The act of acceptance of such objects is drawn up on the date of transfer of the object. It does not matter whether the property rights to the object are registered or not.

They draw up acts on the basis of technical documentation for the fixed asset, as well as accounting data. For example, the turnover on account 02 “Depreciation of fixed assets” will allow you to fill in information about the amount of accrued depreciation.

Acts draw up in two copies, one of which give the buyer. At the same time, do not fill in the section “Information about fixed assets as of the date of acceptance for accounting”. This must be done by the buyer in his copy of the act. Both copies of the act must be signed and approved by both the supplier and the buyer.

In the acts indicate: *

- number and date of compilation;

- full name of the fixed asset according to the technical documentation;

- name of the manufacturer;

- the place of transfer of the fixed asset;

- factory and assigned inventory number of the fixed asset;

- depreciation group number, useful life of the fixed asset and actual service life;

- the amount of depreciation accrued before the sale of the fixed asset, its residual value;

– information about the content of precious metals, stones;

– other characteristics of the fixed asset.

Simultaneously with the preparation of these acts, enter information about the disposal of the fixed asset in the inventory card or in the book (intended for small businesses). These documents can be drawn up according to the forms No. OS-6, OS-6a or OS-6b. Enter the information on the basis of the act of acceptance and transfer.

In acts it is required to refer to the conclusion of the commission. Such a commission should be created in the organization to control the disposal of fixed assets. Commission members can be Chief Accountant, financially responsible persons and other employees. The composition must be approved by the head of the organization by issuing an order.

Sergei Razgulin,

Acting State Councilor of the Russian Federation, 3rd class

Electronic Documents

Primary documents can be drawn up both in paper and in in electronic format(Part 5, Article 9 of the Law of December 6, 2011 No. 402-FZ). The latter option is possible if the documents are signed electronically (). *

Exist the following types electronic signature: simple unqualified, enhanced unqualified and enhanced qualified (). The legal force of the document will depend on the signature used by the organization.

So, primary documents certified by a simple or enhanced unskilled

If the organization decided to draw up primary documents in electronic form, this method of maintaining documentation must be reflected in the accounting policy. In particular, in the accounting policy it is necessary to fix: *

- a list of documents involved in electronic document management;

– a list of employees who have the right to sign electronic documents;

- a method of electronic document exchange (with or without the involvement of an electronic document management operator);

- the procedure for storing electronic documents;

- the method of submitting documents at the request of the tax inspectorate (in electronic form or on paper).

You can add special columns to these forms to enter the necessary tax accounting information. In particular, such:*

- date of commissioning;

- initial cost;

- useful life ( depreciation group);

- depreciation method.

You also have the right to create and approve your own form of commissioning act. The main thing is that it contains all the necessary details. Otherwise, the document is not recognized as primary. For example, you can draw up such an act of commissioning.

In any case, the form of the document with which you draw up the commissioning and capitalization of property as a fixed asset is approved by the head of the order to the accounting policy. *

The conclusion of a special commission will also testify to the readiness of the facility for operation. It is enough to specify it directly in the act of commissioning. To do this, you can attract a commission that is busy accepting the acquired fixed assets. *

In addition, an inventory card or book is added to the fixed asset, depending on how you account for fixed assets. In this case, you can use the following standard forms: No. OS-6, OS-6a, OS-6b.

Situation: how to determine the date when the fixed asset was put into operation

The commissioning date is the day the fixed asset is ready for use. Confirm this with an act or a separate order.*

The moment when you actually start using the property does not matter. After all, ready-to-use property begins to wear out and become morally obsolete immediately. It needs to be amortized. Moreover, if the object is not put into operation, it is not depreciated. This follows from paragraph 4 of Article 259 of the Tax Code of the Russian Federation.

An exception is provided only for mothballed property. But even it is still put into operation first, and then canned.

Attention: if there are no documents confirming the date of putting the fixed asset into operation, during the audit, tax inspectors can exclude the accrued depreciation from the costs taken into account when calculating income tax. This is due to the fact that, in contrast to accounting in tax accounting, depreciation is charged from the next month after the commissioning of an object of fixed assets (clause 4, article 259 of the Tax Code of the Russian Federation). As a result, penalties and fines will be charged on the amount of the organization's arrears. *

To fix the date of commissioning, use standard documents - forms No. OS-1, OS-1a or OS-1b. To do this, add the column "Date of putting the fixed asset into operation" in them. This allows you to do the Procedure for the use of unified forms of primary accounting documentation, approved by the Decree of the State Statistics Committee of Russia dated March 24, 1999 No. 20. Specify additional details in the form No. OS-1 in the accounting policy. *

Alternatively, you can use a commissioning act developed independently, or simply fix the date by order of the manager.

For accounting, the fact of commissioning is not so important. Indeed, as part of fixed assets on account 01, any property that meets the established criteria must be reflected. And it is necessary to start depreciating the fixed asset in accounting after it is accepted for accounting.

If the fixed asset began to actually operate after its registration, then to account 01 () open the sub-accounts “Fixed assets in stock (in stock)” and “Fixed assets in operation”. Accounting for fixed assets reflect in general order wiring:

Debit 01 (03) Credit 08

- the main asset is taken into account.

When the asset is finally in actual use, make the posting:

Debit 01 (03) sub-account "Fixed assets in operation" Credit 01 (03) "Fixed assets in stock (in stock)"

- the main facility was put into operation.

Putting into operation reflect the wiring:

Debit 01 subaccount “Fixed assets, property rights for which are not registered” Credit 08

- a fixed asset is accepted for accounting and put into operation, the ownership of which is not registered.

Taking property into account as a fixed asset, the commission determines its useful life. This period is required for depreciation. In accounting, depreciation is charged from the month following the one in which the fixed asset was registered. That is, after reflection on account 01 (). This is established in Article 259 of the Tax Code of the Russian Federation. At the same time, the period during which the initial cost is written off is usually set based on which PBU 6/01, the useful life is determined based on the following factors:

- the time during which they plan to use the fixed asset to generate income. Including for management needs, production, performance of work, provision of services;

- the period after which the fixed asset is expected to be unsuitable for further use, that is, physically worn out or obsolete. At the same time, the mode (number of shifts) and the negative operating conditions of the fixed asset, as well as the system or frequency of repairs are taken into account;

- regulatory and other restrictions on the use of a fixed asset (for example, the lease term).

Set the useful life of the fixed asset by order of the head, drawn up in free form. In the future, this period can be reviewed only after the reconstruction, modernization, completion or additional equipment of the fixed asset.

In all other cases, the useful life of a fixed asset cannot be revised, regardless of whether or not the fixed asset is operated after the end of the previously established useful life. This procedure follows from paragraph 6 of paragraph 20 of PBU 6/01 and paragraphs).*

Please note: the useful life of a fixed asset, established in accounting, is important when calculating property tax. This is due to the fact that property tax is calculated from the residual value of the fixed asset formed in accounting (clause 1 of article 375 of the Tax Code of the Russian Federation).

The longer the useful life of a fixed asset established for accounting purposes, the longer the organization will pay property tax. Accordingly, the shorter the term, the smaller the amount of property tax the organization will pay to the budget.

Therefore, if in accounting the useful life is set less than in tax accounting, then it is possible that when checking tax office needs to be substantiated. To eliminate these disagreements, in the order, justify the differences in terms for the purposes of accounting and tax accounting.

Sergei Razgulin,

Acting State Councilor of the Russian Federation, 3rd class

Fixed assets entering the economy must be documented and immediately capitalized.

Accounting for the receipt of OS.

The following documents are intended to account for the receipt and posting of incoming fixed assets:

-- Act on the acceptance and transfer of fixed assets (except for buildings, structures) (form No. OS-1)

-- The act of acceptance and transfer of the building (structure) (form No. OS-1a)

-- Act on the acceptance and transfer of groups of fixed assets (except for buildings, structures) (form No. OS-1b)

They are used to register and record operations of acceptance, acceptance and transfer of fixed assets in an organization or between organizations for:

a) inclusion of objects in the composition of fixed assets and accounting for their commissioning (for objects that do not require installation - at the time of acquisition, for objects that require installation - after their acceptance from installation and commissioning), received:

under contracts of sale, exchange of property, donation, financial lease (if the fixed asset is on the balance sheet of the lessee), etc.;

by acquiring for a fee in cash, manufacturing for their own needs and commissioning completed buildings (structures, built-in and attached premises) in the prescribed manner;

b) retirement from fixed assets upon transfer (sale, exchange, etc.) to another organization.

The acts are approved by the heads of the recipient organization and the delivering organization and are drawn up in at least two copies. The act is accompanied by technical documentation related to the given object(s).

For registration and accounting of the movement of fixed assets within the organization from one structural unit (workshop, department, site, etc.) to another, it is used waybill for the internal movement of fixed assets (form No. OS-2). The waybill is issued by the transferring party (deliverer) in triplicate, signed by the responsible persons of the recipient's and the deliverer's structural divisions. The first copy is transferred to the accounting department, the second - remains with the person responsible for the safety of the object (s) of the deliverer's fixed assets, the third copy is transferred to the recipient.

For registration and accounting of acceptance and delivery of fixed assets from repair, reconstruction, modernization, a ct on the acceptance and delivery of repaired, reconstructed, modernized fixed assets (form No. OS-3). The act is signed by members of the acceptance committee or a person authorized to accept fixed assets, as well as a representative of the organization (structural unit) that carried out the repair, reconstruction, modernization. It is approved by the head of the organization or a person authorized by him and submitted to the accounting department.

When transferring young productive and working cattle to the main herd, an act is drawn up for the transfer of animals from group to group (f. 214 - APC).

Waste disposal accounting

After a decision is made to write off a particular fixed asset, an appropriate act is drawn up for the write-off of property:

-- Act on the write-off of fixed assets (except for motor vehicles)

(Form No. OS-4)

-- Act on the write-off of vehicles (form No. OS-4a)

-- Act on the write-off of groups of fixed assets (except motor vehicles) (form No. OS-4b)

They are used to register and record the write-off of those that have become unusable:

Object of fixed assets - according to the form No. OS-4;

Motor vehicles - according to the form No. OS-4a;

Groups of fixed assets - according to the form No. OS-4b.

They are drawn up in duplicate, signed by members of the commission appointed by the head of the organization, approved by the head or a person authorized by him.

The first copy is transferred to the accounting department, the second - remains with the person responsible for the safety of fixed assets, and is the basis for the delivery to the warehouse and the sale of material assets and scrap metal remaining as a result of the write-off.