Enterprise assets are one of the most important categories of financial management. The main characteristics of assets as a management object are as follows.

Assets are the economic resources of the enterprise in their various forms, used in the course of economic activity. They are formed for the specific purposes of carrying out these activities in accordance with the strategy economic development enterprises and in the form of total property values characterize the basis of its economic potential.

The essence of assets as economic resources is manifested in the sphere of economic relations, and more specifically, in the economic sphere of the enterprise. Accordingly, acting as a carrier of economic characteristics, assets are the object of economic management of any economic entity.

Assets are the property values of the enterprise, formed at the expense of the capital invested in them. The capital invested in a new or developing business materializes in the form of enterprise assets. There is a close relationship between the categories of capital and assets: assets can be considered as an object of capital leveling, and capital - as an economic resource intended for investment in assets. Only by investing in assets is capital, as accumulated value, involved in the economic process. It should be noted that the capital directed to the formation of enterprise assets can be invested not only in cash (indirect), but also in real (direct) form, for example, in the form of specific capital goods. In the latter case, assets and capital, being identical in a specific natural-material form, nevertheless have a different economic nature: capital is a product of the past accumulation of values involved in the economic process, and assets are a formed economic resource intended for future economic activity. As for the monetary form of capital investment, it mediates the process of acquiring specific types of enterprise assets.

Assets are the property values of the enterprise that have value. This characteristic of assets is contained in numerous definitions, primarily in the accounting literature. The concept of asset value is based primarily on their value to the enterprise as an economic resource. The level of asset value is determined by the sum of the costs of production factors for their creation, the period of use, compliance with the goals of economic use, market conditions for means and objects of labor, etc. Accordingly, the methods for determining the level of the value of assets and the forms of its presentation are of the most diverse nature.

Assets are only those economic resources that are fully controlled by the enterprise. Such control is understood as the right of ownership of the economic resources used or, in certain cases provided for by law, the right of ownership of their respective types (for example, property values attracted for use under the terms of financial leasing). Economic resources used by an enterprise, but not controlled by it, are not assets. This applies, first of all, to the labor resources used, as well as to property values leased by the enterprise (under the terms of operational leasing) or provided to it for temporary use free of charge.

Assets - as an economic resource used in the economic activity of an enterprise, are characterized by a certain productivity. The bearer of this most important essential characteristic is both the total set of operating assets formed by the enterprise and their individual types represented by means of labor.

Assets are an economic resource that generates income. Assets generate this income, first of all, as economic resources with productivity. The most important feature is that the potential ability of assets to generate income is not realized automatically, but is ensured only in conditions of their effective use. The formation of such conditions predetermines one of the important tasks of asset management.

The assets of the enterprise used in economic activities, which are in the process of constant turnover. The totality of the assets used by the enterprise is modified, first of all, in its real forms - some types of assets in the process of turnover are transferred to their other types (for example, stocks of raw materials - into stocks of finished products; stocks of finished products - into receivables or monetary assets, etc. .).

The use of assets in the business activities of an enterprise is closely related to time factor. This is primarily determined by the cost characteristics of assets, expressed in monetary terms. According to the concept of the time value of money, the same amount of money in different periods time has a different value. Accordingly, the value of an asset is always higher than in any future period, which must be taken into account in the process of its use. It is also necessary to take into account the inflationary component. Finally, the time factor forms a system of possible alternative managerial decisions in the area of specific use, related to the time preferences of managers. In the operating process, time preference determines the alternative choice of opportunities for realizing production goals in time (using assets to produce certain types of products with different time costs).

The economic use of assets is closely related to the risk factor. Risk is the most important characteristic of all forms of their use in the production activities of the enterprise. Assets act as a carrier of the risk factor in close connection with the characteristics of economic resources that generate income. The level of risk of using assets is directly dependent on the level of expected return, forming a single scale "profitability - risk" in the process of implementing various business transactions. This scale reflects the average market quantitative parameters of the level of risk in various forms and types entrepreneurial activity, corresponding to specific parameters of the level of expected return on assets. Using assets to generate income in an operating or investment process, an entrepreneur must always consciously take risks, the measure of which he determines on his own. The risk factor is an important objective attribute of the use of assets and must be taken into account in the process of managing them.

The property values formed as part of the assets are associated with the liquidity factor. The liquidity of assets refers to their ability to be quickly converted into cash at their real market value. This characteristic of assets provides the possibility of their rapid restructuring in the event of adverse economic and other conditions for their use in the formed types. Different types of assets, depending on the universality of their functional purpose, the speed of turnover in the operating or investment process, the level of development of the corresponding type and market segments, and other conditions, have varying degrees of liquidity. Nevertheless, liquidity is an important objective characteristic of all types of assets (except for monetary assets, which are characterized by “absolute liquidity”), which determines the choice of their specific varieties for business activities.

The assets of an enterprise are economic resources controlled by it, formed from the capital invested in them, characterized by a deterministic value, productivity and ability to generate income, the constant turnover of which in the process of use is associated with time, risk and liquidity factors.

There are many types of assets used by an enterprise. IN economic theory and economic practice, more than a hundred terms are used that characterize their individual types. In this regard, in order to ensure effective and purposeful management of the formation and use of enterprise assets, it is necessary first of all to systematize the terminology associated with this process. The assets of the enterprise are classified as follows.

Functioning form:

- fixed assets;

- Construction in progress;

- unfinished production;

- other types of tangible assets;

intangible assets characterize the property values of an enterprise that do not have a material form, but take part in economic activities and generate profit. This type of asset includes:

- rights to use certain natural resources;

- patent rights to use inventions;

- "know-how" - a set of technical, technological, commercial and other knowledge, issued in the form of technical documentation, descriptions of the accumulated production experience, which are the subject of innovations, but not patented;

- trademark;

- trademark;

- other similar types of property values of the enterprise;

financial assets characterize the property values of the enterprise in the form of cash Money, monetary and financial instruments owned by the enterprise. The main financial assets of the company include:

- cash equivalents;

- accounts receivable in all its forms;

- current financial investments;

- long term financial investment.

money characterize the property values of the enterprise, having a material material form. The company's tangible assets include:

By the nature of the participation of assets in the economic process from the standpoint of the features of their turnover:

current (current) assets characterize the totality of the enterprise's property values that serve its current production and commercial activities and are fully consumed during one production cycle. They include:

- production stocks of raw materials and semi-finished products;

- unfinished production;

- finished products intended for implementation;

- current accounts receivable;

- cash in national currency;

- cash in foreign currency;

- cash equivalents;

- current financial investments.

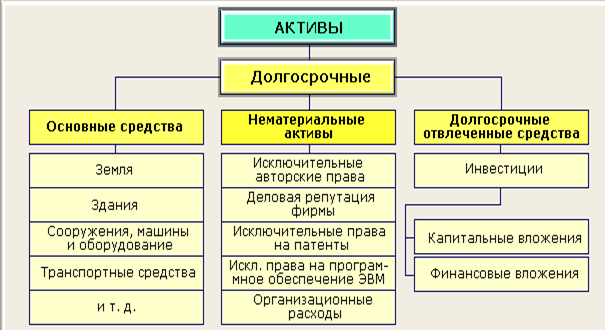

fixed assets characterize the totality of the property values of the enterprise, repeatedly participating in the process of individual cycles of economic activity and transferring the used value to products in parts. In accounting practice, they include property values (assets) of all types with a period of use of more than one year. The non-current assets of the enterprise include:

- fixed assets;

- intangible assets;

- Construction in progress;

- other types of non-current assets.

By the nature of the participation of assets in various types of activities of the enterprise:

operating assets represent a set of property values directly used in the operating activities of the enterprise in order to obtain operating profit. The company's operating assets include:

- production fixed assets;

- intangible assets serving the operational process;

- current assets (their totality minus short-term financial investments);

investment assets characterize the totality of property values of the enterprise associated with the implementation of its investment activities. They include:

- Construction in progress;

- long-term financial investments;

- short term financial investment.

By the nature of financial sources of asset formation:

gross assets represent the entire set of property values of the enterprise, formed at the expense of own and borrowed capital, attracted to finance economic activities;

net assets characterize the total value of the property values of the enterprise, formed exclusively at the expense of its own capital. The value of the net assets of the enterprise is determined by the formula

CHA \u003d A - ZK,

where NA - the value of the net assets of the enterprise;

A - the total amount of all assets of the enterprise at book value;

ZK - the total amount of borrowed capital used by the enterprise.

By the nature of ownership of assets by the enterprise:

own assets characterize the property values of the enterprise, belonging to it on the basis of ownership, being in its permanent possession and reflected in the balance sheet. In accounting practice, this group also includes assets acquired by the enterprise under the rights of financial leasing (which are in its full possession and are also reflected in the balance sheet);

leased assets characterize the property values of the enterprise attracted by it to carry out economic activities on a leasehold basis (operating leasing). These types of assets are reflected in off-balance sheet accounts.

donated assets characterize the property values transferred to the enterprise for temporary economic use free of charge by other business entities. These assets are also not reflected in the balance sheet of the enterprise.

According to the degree of aggregated pasture of assets as an object of management:

- individual assets characterize the type (or variety) of property values, are single, minimally detailed objects of economic management (for example, cash on hand, a separate share acquired by an enterprise; a specific type of intangible assets, etc.);

- group of assets characterizes a part of the property values that are the object of integrated functional management, organized on the same principles and subject to a single financial policy (for example, the company's accounts receivable; "portfolio" of securities; fixed assets, etc.). The degree of aggregation of such groups of assets - objects of functional management, the enterprise determines independently;

- aggregate complex assets characterizes them general composition used by the enterprise. Such a combination is characterized by the term "integral property complex" - an economic object with a complete cycle of production and sale of products, the assessment of assets of which and their management is carried out in a complex.

According to the degree of liquidity of assets:

- cash in national currency;

- cash in foreign currency;

highly liquid assets, characterizing a group of property values of the enterprise, which can be quickly converted into cash (as a rule, within one month) without tangible losses of its current market value in order to ensure timely payments on current financial obligations. The company's highly liquid assets include:

- cash equivalents;

- short-term financial investments;

- short-term accounts receivable.

medium liquid assets, characterizing a group of property values of an enterprise that can be converted into cash without tangible losses of their current market value within a period of one to six months. Medium liquid assets of an enterprise usually include:

- all forms of current accounts receivable, except for short-term and bad debts;

- finished products for sale.

low liquid assets, enterprises representing a group of property values that can be converted into cash without loss of their market value only after a significant period of time (from six months or more). In modern asset management practice, this group includes:

- stocks of raw materials and semi-finished products;

- low-value and fast-wearing items;

- assets in the form of work in progress;

- fixed assets;

- Construction in progress;

- intangible assets;

- long-term financial investments;

- long-term accounts receivable.

illiquid assets, characterizing certain types of property values of the enterprise reflected in the balance sheet, which cannot be sold independently (they can only be sold as part of an integral property complex). These assets include:

- uncollectible receivables;

- Future expenses;

- other similar types of unrealizable assets.

assets in absolutely liquid form, characterizing the property values of the enterprise that do not require sale and are ready-made means of payment. These types of assets include:

By the nature of the use of the formed assets in the current economic activity of the enterprise assets are divided into:

used assets, characterizing that part of the property values of the enterprise, which is directly involved in the operational or investment process, ensuring the formation of income.

idle assets, characterizing that part of the property values of the enterprise, which, being formed at the previous stages of economic activity, do not currently participate in it due to various objective and subjective reasons. These assets include:

- buildings and structures not used by the enterprise;

- unused machines, mechanisms and equipment that have lost their functional properties;

- excessively purchased uninstalled machines, mechanisms and equipment, the use of which in the operating or investment process is inappropriate due to the reduced volume of production activities;

- production stocks of raw materials and materials intended for the production of products subsequently discontinued;

- stocks of finished products, for which there is no demand from buyers due to the loss of the necessary consumer qualities, etc.

By the nature of the location of assets in relation to the enterprise, there are:

- buildings, premises and structures that are part of the property complex of the enterprise, or located on the territory allotted to it;

- machines, mechanisms and equipment delivered to an enterprise that is in the process of storage or direct use;

- raw materials, materials, semi-finished products delivered to the enterprise, which are in the process of storage in the form of work in progress;

- stocks of finished products intended for shipment to customers;

- financial investment instruments stored directly at the enterprise (stocks, bonds, certificates of deposit, etc.);

- cash on hand;

external assets characterize the property values of the enterprise that are outside its boundaries, business entities, in transit or in storage. The main types of such assets are:

- all types of property values belonging to the enterprise that are in transit;

- all forms of external receivables of the enterprise;

- all types of property values of the enterprise that are in storage or in the process of temporary use by other business entities.

internal assets, characterizing the property values of the enterprise located directly on its territory. These types of assets include:

So, a significant number of classification features of assets have been considered, which, however, does not reflect the diversity of their types used in scientific terminology and financial management practice. Further classification requires detailed study.

When managing the assets of an enterprise, it is important to take into account their division according to the nature of participation in various types of its activities. As noted, on this basis, assets are divided into operating and investment.

Operational asset management is one of the complex systems that integrates the methodological principles of financial, operational, innovation management, accounting, controlling, logistics, and also requires the use of other special areas of knowledge. Managers of various functional services of the enterprise participate in the management of operating assets, and the implementation of the adopted management decisions in this area is carried out by almost all of its personnel. The overall coordination of the issues of development and efficient use of the operating assets of the enterprise is entrusted to the financial management service.

Features of managing a complex of operating assets of an enterprise are determined by the nature of its operating activities. Operating activities- this is the key activity of the enterprise, for the purpose of which it was created. Its basis in most enterprises is industrial and commercial or trading activities, which are complemented by their investment and financial activities. The process of managing the formation of operating assets is carried out according to the following main stages.

Analysis of the security of the enterprise with operating assets. The purpose of such an analysis is to identify the main trends in the development of the operating assets of the enterprise and assess the level of provision with them for production and sales.

At the first stage the total cost of operating assets used by the enterprise in the context of individual stages of the analyzed period is determined. This cost is defined as the chronological average for each of the analyzed stages and for the analyzed period as a whole. The total value of the operating assets of the enterprise according to the balance sheet data includes the amount of:

- fixed assets at residual value;

- intangible assets at residual value;

- current assets of all kinds.

The considered stages are selected, as a rule, separate quarters of the analyzed period.

At the second stage dynamics trends are revealed total cost operating assets of the enterprise in the period under review, for which financial analysis tools are used.

At the third stage the provision of the enterprise with operating assets is analyzed. For this purpose, the indicator of the unit cost of operating assets per unit of output is used using the following formula:

where ps">ps">OR - the volume of production (sales) of products in the period under review.

The analysis of the provision of the enterprise with operating assets is carried out in dynamics by individual stages of the analyzed period (based on the use of horizontal financial analysis methods), as well as in comparison with industry average indicators, competitors, etc. (based on the use of methods of comparative financial analysis).

Taking into account the results of the provision of the enterprise with operating assets in the last of the considered stages of the preplanning period, those elements of the production and financial potential that are formed by the corresponding types of operating assets are evaluated.

Determining the need for the total volume of operating assets for the coming period. For existing enterprises, this need is determined in the form of an increase in these assets based on the planned volume of increase in production (sales) of products and the unit cost of operating assets (adjusted for the growth opportunities for their productivity, discovered during the analysis).

More difficult is to determine the need for total operating assets for newly created enterprises. The composition of the operating assets of such an enterprise has a number distinctive features. So, in the composition of current assets there is no current receivables due to the fact that operating activities have not yet begun. In addition, cash equivalents and short-term financial investments are reduced to a minimum (and in most cases completely absent). They are included in turnover only if the contribution of the founders to the fund is made in the form of such short-term financial instruments. And, finally, the stocks of such enterprises do not include stocks of finished products (with the exception of trade enterprises). So, the calculation of the need for assets of a newly created enterprise is carried out in the context of their types:

- fixed assets;

- intangible assets;

- stocks of inventory items that ensure production activities;

- monetary assets;

- other types of assets.

Need for fixed assets calculated according to the following classification groups:

a) industrial buildings and structures;

b) machines and equipment used in the production process;

c) machinery and equipment used in the process of managing operations.

At the first stage the need for certain types machines and equipment used in the production process:

where ps "\u003e OP - the planned volume of production requiring the use of this type of equipment;

ps "\u003e Ce - the cost of a unit of the considered type of equipment;

Y - the cost of installing the considered type of equipment;

At the second stage the need for certain types of machines and equipment used in the process of managing operations is determined (office furniture, electronic computers, communications, etc.).

At the third stage the need for premises (buildings) is determined for the implementation of the direct production process (with all its auxiliary types) and the placement of management personnel.

Need in intangible assets is determined based on the technology used for the implementation of the operational process. When determining the cost volume of non-current operating assets required by the enterprise, the form of satisfaction of the need for their individual types is taken into account - the acquisition of ownership, financial or operational leasing.

Need in inventories is calculated differentially in the context of the following types:

a) the need for working capital advanced in stocks of raw materials and materials;

b) the need for working capital advanced in stocks of goods (for trade enterprises).

Need in monetary assets is determined on the basis of their forthcoming spending on payroll calculations (excluding accruals on it); on advance and tax payments; for marketing activities (advertising expenses); for utilities, etc.

Need in other operating assets is established by the method of direct counting for their individual varieties, taking into account the characteristics of the enterprise being created. The calculation of the need for other assets is carried out separately for non-current and current assets. Based on the results of the calculations, the need for operating non-current and current assets of a newly created enterprise is determined by summing up the needs for various components of the assets.

The form for calculating the need for the assets of the enterprise being created is given in Table. 4.1.

|

Types of enterprise assets required |

Calculation options (conventional monetary unit) |

||

|

Minimum |

Required |

Maximum |

|

|

fixed assets- in total, including: | |||

|

Total non-current operating assets | |||

|

Inventories- in total, including: | |||

|

Total current assets | |||

|

Total need for operating assets | |||

|

© Distance Education Center MGUP |

|||

Cash advanced for the acquisition of fixed assets is called fixed assets. Fixed assets (funds) are the material and technical basis of production at any enterprise. In a market economy, the initial formation of fixed assets, their functioning and expanded reproduction is carried out with the direct participation of finance. At the time of acquisition of fixed assets and their acceptance on the balance sheet of the enterprise, the value of fixed assets quantitatively coincides with the value of fixed assets. In the future, as the fixed assets participate in the production process, their value bifurcates: one part of it, equal to depreciation, is attributed to finished products, the other expresses the residual value of existing fixed assets.

Economic entity the main assets, therefore, lies in the fact that they are material values that are repeatedly used in the production process as means of labor in a number of cycles of circulation and their value is gradually transferred to the created product in parts.

Fixed assets are tangible assets that operate for a long period of time (more than one year), both in the sphere of material production and in the non-production sphere.

The forms of valuation of fixed assets are as follows: initial, current, balance sheet, cost of sale, liquidation. Each of these forms expresses a certain set of financial relations and various methods of regulation.

Initial cost is the cost of the actual costs incurred to construct or acquire property, plant and equipment, including non-refundable taxes and fees paid, as well as the costs of delivery, installation, installation, commissioning and any other costs directly related to bringing the asset to working condition for its use for appointment.

current value- is the value of fixed assets at current market prices on a certain date.

Book value- this is the initial or current cost of fixed assets minus accumulated depreciation, at which the asset is reflected in accounting and reporting.

Implementation cost- is the cost at which the exchange of fixed assets between well-informed and ready to carry out the transaction independent parties is possible.

Liquidation value- the estimated cost of spare parts, scrap, waste arising from the disposal of fixed assets at the end of their useful life, less the expected disposal stocks.

Fixed assets operate during their service life, after which they are out of circulation. This necessitates renewal, replacement or upgrade. The disposal of fixed assets is possible different reasons, including due to complete wear and tear or the impossibility of continuing operation, by sale, lease, transfer as a founding contribution to the authorized capital of a commercial organization, gratuitous transfer.

The depreciation of fixed assets that is constantly accumulated in monetary terms for subsequent use to reproduce the value of assets is called depreciation.

Depreciation is calculated by applying various methods:

1) uniform (straight-line) write-off of value;

2) cost write-off in proportion to the volume of work performed (production method);

3) accelerated write-off:

- declining balance

- writing off the cost by the sum of numbers

(cumulative method).

TO various types fixed assets it is allowed to use different methods of depreciation. At the same time, no more than one method should be applied to one type of fixed assets.

Accrued depreciation depends on fairly stable (at least for annual periodicity) values

- average annual cost of fixed assets and depreciation rates approved by legislative (regulatory) acts.

For fixed assets for which depreciation is not charged, depreciation is calculated based on the value of fixed assets and the standard time they have been in operation.

Depreciation of fixed assets is determined for all types of fixed assets except for:

- library funds;

- productive livestock, oxen, buffaloes;

- perennial plantations that have not reached the operational age;

- funds transferred to in due course for conservation;

- museum and art treasures etc.

Let us dwell on the individual methods of depreciation.

In accordance with the Accounting Standard No. 6, approved by the Resolution of the National Commission of the Republic of Kazakhstan on accounting dated November 13, 1996 No. 3 from 1.01.97 it is allowed to apply accelerated depreciation method.

With accelerated depreciation, its rate increases by 2 times. This means that a new estimated life of the fixed assets is determined, which allows for the full transfer of depreciable cost within a short period of time. Accelerated accrual of the depreciation fund is a guarantee against losses from obsolescence of fixed assets caused by incomplete reimbursement of their value.

Number sum method- the method of accelerated depreciation write-off, as a result of which, at the beginning of the useful life of fixed assets, the amount of depreciation written off is greater than in a straight-line write-off, when equal amounts are written off annually, which saves on the amount of taxes paid in the first years of the useful life of the main equipment. For the calculation, the sum of the numbers of the useful life of the equipment is determined, For example, if 4 years, then the sum of 4, 3, 2, 1 equals 10. In the first year, 4/10 of the depreciable cost of assets will be written off, in the second year - 3/10, etc.

In international practice, it is also used direct method. When using the direct method of writing off depreciation, its value will decrease by the amount of accrued depreciation.

So, For example, a truck purchased by the company for the purpose of transporting goods, was bought for 10 thousand conventional units. units and its service life is estimated at 5 years, which means that in this case the cost will decrease by 2 thousand conventional units. units in year. At the end of the first year of operation, its net book value (cost less depreciation) will be 8 thousand conv. units; at the end of the second year - 6 thousand conv. units, since the accrued depreciation is estimated at 4 thousand cond. units

Accrued depreciation is calculated only for such items as buildings, equipment, leased property, furniture fittings.

Land is not subject to impairment and its carrying value remains unchanged. When evaluating land plots, the cost of their acquisition is taken as the base. The costs of construction in progress and the acquisition of property are subject to depreciation only after the commissioning of existing facilities.

The term "depletion" is used in the balance sheets of mining and oil firms. When an oil source or a source of other minerals is fully utilized or sold, this is reflected in the firm's balance sheet under "Depletion", which gives a valuation of natural resources that the firm no longer has.

In some firms, fixed assets are periodically revalued to better reflect their current value.

Organization asset classification

To solve problems, it is necessary to assimilate the composition of the organization's assets, which are understood as economic resources that provide income and are reflected in the accounting in the valuation.

For the purposes of accounting and analysis of economic activity, assets are grouped according to a number of criteria.

When classifying assets by type, they are usually divided into a number of groups.

To the first group include means of labor, including several types of assets - fixed assets, intangible assets, inventory and household supplies.

fixed assets - this is a part of the means of labor, with the help of which a person acts in the production process on objects of labor in order to obtain a certain product (works, services). The main feature of fixed assets is that they long time in an unchanged natural form, they function in the production process and gradually transfer their value to the manufactured product in the form of depreciation deductions.

In accounting, fixed assets include labor instruments for which the useful life exceeds 12 months - buildings and structures, machinery and equipment, tools, vehicles.

Fixed assets are operated in the sphere of production, in the sphere of circulation and in the non-production sphere, creating favorable conditions for the reproduction of the labor force.

Intangible assets (NML) - accounting objects that do not have physical properties, but allow the organization to receive income constantly or for a long period of their operation. Intangible assets include objects of intellectual property: exclusive copyrights for patents, trademarks, databases, computer programs. Intangible assets, like fixed assets, can transfer their value to the finished product in parts. They are used both in the sphere of production and in the sphere of circulation.

Inventory and household supplies - means of labor that are used in economic circulation for less than 12 months. To facilitate the process of reproduction, they are taken into account as part of the funds in circulation.

To the second group of active in include objects of labor.

Objects of labor - part of the means of production, which is affected by a person in the process of labor with the help of means of labor. Objects of labor participate once in the production process and transfer their entire value to the manufactured products. These include: raw materials and materials, fuel, semi-finished products, work in progress, spare parts, packaging.

Under the raw understand products Agriculture and extractive industries, and under materials - products of manufacturing industries.

materials according to their role in the process of manufacturing products are divided into two groups: raw materials and basic materials, auxiliary materials.

Raw materials and basic materials form the material basis of the product, auxiliary materials are used to perform certain functions.

Fuel in terms of its role in the production process, it belongs to auxiliary materials, but since it occupies a large share in the cost of production and performs special functions in the production process, it is distinguished in accounting in a separate group.

Semi-finished products- objects of labor that have been processed in one or more departments of the organization, but are subject to further processing in this organization or outside it.

To work in progress include objects of labor that are being processed in departments at workplaces.

The third group of assets constitute the objects of circulation.

Items of circulation - finished products in the warehouse of the organization, intended for sale, and goods shipped. Goods shipped are the property of the organization until the buyer passes ownership of them.

to the fourth group assets include cash. Cash means the organization's funds on settlement and other bank accounts from which settlements are made with suppliers and buyers, banks, financial authorities by means of non-cash transfers. Small amounts of cash can be kept in the cash desk of the organization within the established limit.

to the fifth group include funds in settlements. Under the funds in the calculations understand the debts of other legal entities or individuals of this organization. Such debt is called accounts receivable, and the debtors themselves are called debtors. Accounts receivable arise as a result of existing forms of payment for products, works and services in the event that their transfer to the buyer and payments for them do not coincide in time. Employees of the organization can also be debtors; such debtors are called accountable persons.

Part of the organization's assets may for some reason not participate in the economic cycle. They are called abstract assets. They include investments.

Investments are long-term investments. In their composition, the organization's investments in its own activities and investments in other organizations are distinguished.

Investments in own activities include long-term investments in fixed assets and intangible assets (capital investments).

Investments in other organizations are short-term and long-term financial investments. These include investments of cash or other property in other organizations for the purpose of generating income or control over their activities: investments in authorized capital, shares, bonds.

Distracted funds also include losses (losses of assets) as a result of irrational management or natural Disasters. This part of the assets is removed from economic circulation (task 1.1).

The assets of an economic entity can be grouped according to the place of their use. In this case, all the assets of the organization can be divided into assets used in the sphere of production (fixed assets, intangible assets, inventories), in the sphere of circulation (fixed assets and NML serving the sphere of circulation, cash, objects of circulation and funds in settlements) and abstract assets (task 1.2).

Grouping assets by time of use involves dividing them into long-term assets and current ones.

Long term assets - economic resources of the organization used for a long time. These include: fixed assets, intangible assets, a part of abstract assets (except for short-term financial investments and losses).

Part current assets objects of labor, inventory and household supplies, cash, objects of circulation, funds in settlements and abstract assets are included (task 1.3).

The assets of the organization are formed as a result of attracting them from various sources, so the organization has obligations to other organizations and persons - creditors.

Depending on the mechanism of formation and maturity of obligations, equity capital and borrowed capital are distinguished.

Equity - the most important source of formation of assets of the “economy. Equity capital includes authorized capital, additional capital, reserve capital, retained earnings, targeted financing.

Authorized capital - the value of the property contributed by the owners or shareholders (participants) at the time of the establishment of the organization (contributions of the founders, the cost of fixed assets, intangible assets) to ensure its activities. The authorized capital may change.

retained earnings - part of the profit of the organization, remaining at its disposal as a source of financing.

Reserve capital (fund) is formed from the profit of the organization and is used to cover losses resulting from extraordinary circumstances and the payment of dividends and income in case of insufficient profit.

Extra capital - the organization's own capital, formed as a result of additional contributions by the owners of funds in excess of the registered authorized capital, a change in the value of property as a result of revaluation.

Special-purpose financing - funds received from the state, other legal entities and individuals for the implementation of specific activities.

In case of insufficiency of own funds, organizations attract capital from the outside. To attracted capital include long-term and short-term liabilities.

Under understand long-term obligations loans and borrowings maturing in more than 12 months after the reporting date.

TO loans include the amounts of shares of the labor collective issued and sold by the organization, bonds.

Bank loans - the amount of funds received from the bank. Long-term (more than one year) loans are used to finance capital investments in fixed assets and technologies.

to short-term liabilities include: short-term loans and borrowings, accounts payable, deferred income, reserves for future expenses.

Short-term credits and loans - liabilities to banks and other organizations, the maturity of which does not exceed 12 months after the reporting date.

Accounts payable - the organization's debts to suppliers for goods and services, for promissory notes issued, for advances received. The same group includes debts to employees for accrued but not paid wages arising from the fact that the moment of accrual and payment of wages does not coincide in time. This is the same mechanism for the formation of debts to the social insurance and security bodies, to the budget for taxes.

revenue of the future periods - funds received in advance, the repayment of debts on which is expected in the next reporting periods (receipt of an advance for an object that will be built over several reporting periods).

Reserves for future expenses are created by the organization in order to evenly include in the expenses of the reporting period the costs of paying employees' holidays, repairing fixed assets. Until the moment of use, they are considered as borrowed funds (task 1.4).

The first group of tasks is designed to master the main issues of this chapter (tasks 1.1 - 1.4).

Classification and types of assets of the enterprise are divided depending on the nature of ownership, form of use, composition, degree of liquidity and other main features. What are company assets? How are they reflected in the company's balance sheet? Let's analyze the structure of business property values from the position of financial management - a detailed table of indicators with examples is given below.

The concept and classification of assets

All assets are divided into large groups covering both tangible and intangible objects. At the same time, the property of the enterprise includes not only inventories, fixed assets, intangible assets, but also cash and equivalents, as well as financial investments, that is, any values whose value can be expressed in monetary terms. There are many types of assets that are reflected on the right side of the balance sheet, balancing the total capital of the enterprise (liability).

Asset classification:

- Turnover speed- for long-term non-current (with a turnover rate in financial and economic activities of more than 12 months) and short-term current (continuously participate in the company's activities).

- By degree of liquidity- depending on the speed of transformation of an asset into free cash, they are divided into the most liquid (A1), hard-to-sell (A4) and medium - quickly-sold (A2), as well as slowly-sold (A3).

- By substance or materiality– for tangible or real assets - This, for example, finished products, goods, raw materials, fuels and other physical values. This group also includes intangible objects (goodwill, software, trademarks, etc.) and financial objects (investments, cash and non-cash funds, receivables).

- According to the sources of formation– for total gross and net . The former are also referred to as total total assets - in the balance sheet, this is the final indicator of the “Assets” section. Net assets are calculated in the prescribed manner, based on the formed assets only at the expense of the company's own funds. Obtaining negative assets as a result of the indicator can be one of the main signs of the need for forced liquidation of a business.

- By nature of ownership- for rented, used free of charge or own.

- By type of tax- for deferred assets, accounted for on account. 09, and deferred tax liabilities assumed under c. 77. The concepts are used by those firms that use the rules of PBU 18/02 in order to legally reduce the taxable base for income tax.

- According to the degree of conditionality of valuation of obligations– for contingent liabilities and contingent assets in accordance with PBU 8/2010.

- When working with various financial instruments- allocate underlying assets.

- When acquiring fixed assets at the expense of borrowed obligations- the term investment asset is used, that is, such a property object, work with which requires additional funding and a long time.

- Other assets- This those objects that, according to the decision of the enterprise, do not represent a priority value for it. Such a gradation is established by each company independently, depending on the industry-specific activity, legal status, production characteristics and other economic factors.

Types of assets - table

For ease of perception of information, the main types of assets are collected in the table below. Separately given concrete examples according to the mentioned classification.

Asset table:

|

Classification sign |

Type of asset |

Asset example |

|

Turnover speed |

|

|

|

Liquidity |

|

|

|

By materiality |

|

|

|

By legal nature of ownership |

|

|

|

According to the sources of formation |

|

|

|

To attract borrowed money |

|

|

|

In order of importance for the enterprise |

|

|

Rare types of assets:

- Distressed assets are those that are extremely difficult to sell due to various legal and financial burdens. For example, distressed assets are property under arrest, pledged; monetary debts of companies refusing to fulfill their obligations; objects with contested title, etc.

- Reserve assets are those that are under the direct control of the government. Stock large companies, international bank accounts, monetary gold, SDRs (special drawing rights), etc., are all reserve assets.

- Information assets are intangible objects that are important for the enterprise. For example, an information asset is a company's databases, business image, etc.

- Economic assets are those objects, individual or joint ownership of which brings to the owners a certain economic benefit.

Practical lesson No. 2 in the discipline "Accounting and analysis"

Subject: Classification of enterprise assets

Target: Learn to group the assets of an economic entity by time of use and by sources of education

Classification of enterprise property

Enterprises use a variety of resources to carry out business activities. They are the assets of an economic entity and are reflected in the accounting in the valuation. The composition of the assets is quite diverse. For the purposes of accounting and analysis, they can be grouped according to a number of characteristics: by types, places of operation, by time of use in the production process and sources of education.

Classification of enterprise assets by type

This grouping shows what resources an economic entity has. When classifying assets on this basis, they are usually divided into a number of groups (2.1).

Rice. 2.1. Classification of enterprise assets by type

The first group includes means of labor, including fixed assets and intangible assets (Figure 2.1).

fixed assets- this is a part of the means of labor, with the help of which a person acts in the production process on the object of labor in order to obtain a certain product (works, services).

They operate and are used in economic activities for a long time, more than one year, without changing their appearance, wear out gradually. This allows the enterprise to include the cost of fixed assets in the cost of products, works, services in parts, during the standard period of their service by calculating depreciation (wear and tear) according to established standards.

These include buildings, structures, machinery, equipment, vehicles, etc.

Rice. 1.2. The composition of the means of labor

Intangible assets (IA)– objects that do not have physical properties, i.e. having no material basis. But they provide the company with income constantly or for a long period of their operation.

Intangible assets include:

· exclusive rights to the results of intellectual activity (patents, inventions);

the exclusive right of the owner to the trademark;

business reputation of the company;

Intangible assets, like fixed assets, transfer their initial cost to production costs during their standard service life by accruing depreciation (wear and tear) according to established standards.

Co. second group of assets include objects of labor (Fig. 2.3).

|

Rice. 2.3. The composition of the objects of labor

Objects of labor- this is a part of the property, which is affected by a person in the process of labor with the help of means of labor. Objects of labor participate once in the production process and transfer their entire value to the manufactured products. These include raw materials and materials, fuel, semi-finished products, work in progress, spare parts, packaging.

Under raw materials understand the products of agriculture and extractive industries, and under materials- products of manufacturing industries.

materials according to their role in the process of manufacturing products are divided into two groups: raw materials and basic materials, auxiliary materials. The first group is the material basis of the product, and the second is used to perform certain functions. For example, auxiliary materials can give normal operating conditions for fixed assets (lubricants), change the qualitative characteristics of objects of labor (dyes), and be used for economic purposes.

Semi-finished products- objects of labor that have been processed in one or more workshops of the enterprise, but are subject to further processing at this enterprise or outside it.

· Unfinished production- objects of labor being processed in workshops at workplaces; products (works) that have not passed all the stages (phases) provided for by the technological process, as well as incomplete products that have not passed tests and technical acceptance;

Fuel refers to auxiliary materials, but since it occupies a large share in the cost of production and performs special functions in the production process, it is separated into a separate group in accounting.

Spare parts- these are objects of labor intended for the repair and replacement of worn out parts of fixed assets (assemblies, parts, etc.).

Tara- part of the objects of labor used for packaging or storage of materials, finished products, etc.

TO inventory and household supplies include part of the means of labor used in economic activity for less than one year. In order to simplify the procedure for reproduction, they are included in the composition of funds in circulation (tools, inventory, household supplies).

The third group of assets constitute the objects of circulation (Fig. 2.4).

Rice. 2.4. The composition of the subjects of circulation

Subjects of circulation - this is a finished product in the warehouse of the enterprise , intended for sale, and goods shipped. Goods shipped are the property of the company until the buyer passes ownership of them.

to the fourth group cash relate:

· cash in the company's cash desk,

free cash kept on settlement, currency and other bank accounts,

Securities (stocks, bonds, savings certificates, bills of exchange).

Rice. 2.5. Composition of cash

Funds in settlements- these are the debts of other organizations or persons to this enterprise. Such debt is called accounts receivable, and the debtors themselves are called debtors. This is a debt for goods and services, products for advances issued, for bills received. Accounts receivable arises as a result of existing forms of payment for goods and services, products, in the event that their transfer to the buyer and payments for them do not coincide in time.

Employees of the enterprise can also be debtors. These debtors are called accountable persons.

Rice. 2.7. Composition of abstract assets

In turn, abstract assets are divided into long-term and short-term. Short-term diverted assets can be represented short-term financial investments And losses.

Under investments refers to long-term investments. They include capital investments of the enterprise itself and long-term financial investments in other organizations.

Under capital investments understand the costs incurred in connection with the construction or acquisition of fixed assets or intangible assets.

Long-term and short-term financial investments- is the investment of money or other property in other organizations for the purpose of generating income or control over their activities. These include investments in authorized capital, shares, bonds.

Losses- is the loss of assets as a result of irrational management or natural disasters. This part of the assets is completely eliminated from economic circulation. Each organization has established control over losses by the time of their occurrence and the procedure for their coverage.

Grouping assets by time of use involves dividing them into long-term and current assets.

This grouping has great importance in control over the formation of the cost of products, works, services.

Long term assets- this is a part of the economic resources of an economic entity used for a long time. These include fixed assets, intangible assets, a part of abstract assets (except for short-term financial investments and losses).

Part current assets objects of labor, money, objects of circulation, funds in settlements and a part of abstract assets are included.

Task 2. 1.

Group economic assets of CJSC "Stroyindustriya" by type of property as of February 1, 20____.

Initial data:

| No. p / p | Name of property and sources of its formation | Amount, rub. |

| 1. | Brick | 284.000 |

| 2. | Retained earnings of previous years | 1.202.000 |

| 3. | Debt to the car depot for the services provided | 65.200 |

| 4. | Slate | 146.400 |

| 5. | Computers | 282.110 |

| 6. | Telefax | 92.000 |

| 7. | Debt Energosbyt for electricity | 6.000 |

| 8. | Debt to the slate factory for materials | 124.200 |

| 9. | Cranes | 210.000 |

| 10. | Reinforced concrete structures and details | 186.000 |

| 11. | Dye | 2.050 |

| 12. | Water pipes | 12.000 |

| 13. | Sand | 1.400 |

| 14. | Forwarder's debt on accountable amounts | 3.200 |

| 15. | Cash on hand | |

| 16. | revenue of the future periods | 824.000 |

| 17. | Overalls and footwear | 14.200 |

| 18. | Bulldozers | 482.000 |

| 19. | Administration building | 607.000 |

| 20. | Cash in bank account | 2.403.000 |

| 21. | Debt to the budget for taxes | 182.100 |

| 22. | Indebtedness of customers for the construction objects handed over to them | 410.000 |

| 23. | Nails | 7.200 |

| 24. | Indebtedness to employees of the enterprise wages | 704.000 |

| 25. | Debt to the supplier for cement and sand | 302.000 |

| 26. | Trucks | 366.500 |

| 27. | Object under construction | 5.518.840 |

| 28. | Authorized capital | 2.000.000 |

| 29. | Acquired software on the right to use | 9.800 |

| 30. | Extra capital | 542.800 |

| 31. | Long-term bank loans | 1.800.000 |

| 32. | Reserve capital | 290.000 |

| 33. | Advance received from the customer | 750.000 |

| 34. | Cash in a bank account | 120.000 |

| 35. | lumber | 36.400 |

| 36. | Profit of the reporting year | 2.402.000 |

| TOTAL: | 22.388.600 |

Make a grouping of property by type and summarize the data obtained in Table 2.1.

Table 2.1

| No. p / p | Group | Asset subgroup | Types of assets | Amount, rub. |

| I | Means of labor | fixed assets | ||

| Intangible assets | ||||

| Total means of labor | ||||

| Objects of labor | Objects of labor | brick | ||

| Total objects of labor | ||||

| II | Items of circulation | Items of circulation | ||

| Total items in circulation | ||||

| Cash | Cash | |||

| Total Money | ||||

| Funds in settlements | Funds in settlements | |||

| Total funds in settlements | ||||

| Distracted Assets | Distracted Assets | |||

| Total Distracted Assets | ||||

| Total assets |

Task 2.2

Based on the data for completing the task, group the property of the organization by type of education.

Initial data: