Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Hosted at http://www.allbest.ru/

ToURTS WORK

« Accounting for material assets»

Introduction

Not a single enterprise can do without the use of material values in its economic activities. Given the importance of the correct distribution and efficient use of material assets, as well as the need for constant accounting and control of their distribution, it is advisable to establish in the organization effective system accounting for stocks and valuables employed in the activities of the organization.

The purpose of writing this paper is to study the procedure for accounting for material values.

In the course of achieving the goal, the following tasks are solved: the concept and classification of material values are determined; the documentary registration of operations for the accounting of material assets is determined; the procedure for assessing and accounting for the receipt of material assets in the organization is determined; the procedure for recording operations for the disposal of material assets; the procedure for organizing warehouse accounting and storage of material assets; the procedure for conducting an inventory of material assets is determined; determines the procedure for assessing material assets in the preparation financial statements.

1. The concept and classification of material values

In accordance with PBU 5/2001 “Accounting for inventories”, the following assets are accepted as inventories:

used as raw materials, materials, etc. in the production of products intended for sale (performance of work, provision of services);

intended for sale;

used for the management needs of the organization.

The main tasks of accounting for inventories are:

a) the formation of the actual cost of inventories;

b) correct and timely documentation of operations and provision of reliable data on the procurement, receipt and release of stocks;

c) control over the safety of stocks in the places of their storage (operation) and at all stages of their movement;

d) control over compliance with the stock standards established by the organization, ensuring the uninterrupted production of products, the performance of work and the provision of services;

e) timely identification of unnecessary and surplus stocks for the purpose of their possible sale or identification of other opportunities for their involvement in circulation;

f) analysis of the effectiveness of the use of reserves.

The main requirements for accounting of inventories:

Continuous, continuous and complete reflection of the movement (inflow, flow, movement) and the availability of stocks;

Accounting for the quantity and estimation of stocks;

Efficiency (timeliness) of inventory accounting;

Reliability;

Compliance of synthetic accounting with analytical accounting data at the beginning of each month (in terms of turnover and balances);

Compliance of warehouse accounting data and operational accounting of the movement of stocks in the departments of the organization with the data accounting.

Classification of materials. Depending on the role played by various inventories in the production process, they are divided into following groups: raw materials and basic materials, auxiliary materials, purchased semi-finished products, waste (returnable), fuel, packaging and packaging materials, spare parts, inventory and household supplies.

Raw materials and basic materials are the objects of labor from which the product is made and which form the material (material) basis of the product. Raw materials are the products of agriculture and the mining industry (grain, cotton, livestock, milk, etc.), and materials are products of the manufacturing industry (flour, fabric, sugar, etc.).

Auxiliary materials are used to influence raw materials and basic materials, to give the product certain consumer properties, or to maintain and care for tools and facilitate the production process (spices in sausage production, lubricants, cleaning materials, etc.).

It should be borne in mind that the division of materials into basic and auxiliary is conditional and often depends only on the amount of material used for production. various kinds products.

Purchased semi-finished products - raw materials and materials that have passed certain stages of processing, but are not yet finished products. In the manufacture of products, they play the same role as the main materials, i.e. constitute their material basis.

Returnable production waste - the remains of raw materials and materials formed in the process of their processing into finished products, which have completely or partially lost the consumer properties of the original raw materials and materials (sawdust, shavings, etc.).

From the group of auxiliary materials, fuel, containers and packaging materials, spare parts are separately distinguished due to the peculiarity of their use.

Fuel is divided into technological (for technological purposes), motor (fuel) and household (for heating).

Containers and packaging materials - items used for packaging, transportation, storage various materials and products (bags, boxes, boxes). Spare parts are used to repair and replace worn parts of machines and equipment.

Inventory and household supplies are part of the organization's inventory, used as means of labor for no more than 12 months or the normal operating cycle, if it exceeds 12 months (inventory, tools, etc.).

In addition, materials are classified according to their technical properties and are divided into groups: ferrous and non-ferrous metals, rolled products, pipes, etc.

The indicated classifications of inventories are used to build synthetic and analytical accounting, as well as to compile a statistical report on the balances, receipts and consumption of raw materials and materials in production and operational activities.

The accounting unit of inventories is chosen by the organization independently in such a way as to ensure the formation of complete and reliable information about these reserves, as well as proper control over their presence and movement. Depending on the nature of inventories, the procedure for their acquisition and use, a unit of inventories can be an item number, batch, homogeneous group, etc.

For the correct organization of accounting, a nomenclature is being developed - a price tag - a systematic list of names of materials. With their characteristics, item numbers and discount prices. Subsequently, the release and movement of materials is documented in documents that indicate the item number.

2. Documentation, evaluation and accounting of the receipt of material assets

accounting material accounting value

Inventories are accepted for accounting at actual cost.

The actual cost of inventories purchased for a fee is the amount of the organization's actual costs for the acquisition, with the exception of value added tax and other refundable taxes (except as otherwise provided by law Russian Federation).

The actual costs of acquiring inventories include:

amounts paid in accordance with the contract to the supplier (seller);

amounts paid to organizations for information and consulting services related to the acquisition of inventories;

customs duties;

non-refundable taxes paid in connection with the acquisition of a unit of inventory;

remuneration paid to an intermediary organization through which inventories are acquired;

costs for the procurement and delivery of inventories to the place of their use, including insurance costs. These costs include, in particular, the cost of procurement and delivery of inventories; the costs of maintaining the procurement and storage unit of the organization, the costs of transport services for the delivery of inventories to the place of their use, if they are not included in the price of inventories established by the contract; accrued interest on loans provided by suppliers (commercial loan); accrued prior to the accounting of inventories, interest on borrowed funds, if they are involved in the acquisition of these inventories;

the costs of bringing inventories to a state in which they are suitable for use for the planned purposes. These costs include the costs of the organization for processing, sorting, packing and improving the technical characteristics of the received stocks, not related to the production of products, the performance of work and the provision of services;

other costs directly related to the acquisition of inventories.

General business and other similar expenses are not included in the actual costs of acquiring inventories, except when they are directly related to the acquisition of inventories.

The actual cost of inventories during their manufacture by the organization itself is determined based on the actual costs associated with the production of these inventories. Accounting and formation of costs for the production of inventories is carried out by the organization in the manner established for determining the cost of the relevant types of products.

The actual cost of inventories contributed as a contribution to the authorized (share) capital of the organization is determined based on their monetary value agreed by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation.

The actual cost of inventories received by the organization under a donation agreement or free of charge, as well as those remaining from the disposal of fixed assets and other property, is determined based on their current market value as of the date of acceptance for accounting.

The actual cost of inventories received under contracts providing for the fulfillment of obligations (payment) in non-monetary means is the cost of assets transferred or to be transferred by the organization. Assets transferred or to be transferred by an entity are valued at the price at which the entity would normally charge similar assets in comparable circumstances.

If it is impossible to establish the value of the assets transferred or to be transferred by the organization, the cost of inventories received by the organization under contracts providing for the fulfillment of obligations (payment) in non-monetary funds is determined based on the price at which similar inventories are acquired in comparable circumstances.

The actual cost of inventories also includes the actual costs of the organization for the delivery of inventories and bringing them into a condition suitable for use.

The actual cost of inventories, in which they are accepted for accounting, is not subject to change, except in cases established by the legislation of the Russian Federation.

Inventories that do not belong to the organization, but are in its use or disposal in accordance with the terms of the contract, are accepted for accounting in the assessment provided for in the contract.

Inventories for which during the reporting year the market price has decreased or they have become morally obsolete or have completely or partially lost their original qualities are reflected in balance sheet at the end of the reporting year at the current market value, taking into account the physical condition of the reserves. The decrease in the cost of inventories is reflected in accounting in the form of a reserve accrual.

A reserve for the decline in the value of material assets is created for each unit of inventories accepted in accounting. It is allowed to create reserves for depreciation of material assets by certain types(groups) of similar or related inventories. It is not allowed to create reserves for the decrease in the value of material assets for such enlarged groups(types) of inventories, as basic materials, auxiliary materials, finished products, goods, stocks of a certain operating or geographic segment, etc.

The calculation of the current market value of inventories is made by the organization on the basis of information available before the date of signing the financial statements. The calculation takes into account:

Change in price or actual cost directly related to events after the reporting date, confirming the economic conditions that existed at the reporting date in which the organization conducted its activities;

Appointment of inventories;

The current market value of finished products, the production of which uses raw materials, materials and other inventories. A reserve for the decline in the value of material assets is not created for raw materials, materials and other inventories used in the production of finished products, works, services, if on the reporting date the current market value of these finished products, works, services corresponds to or exceeds its actual cost .

The organization must provide confirmation of the calculation of the current market value of inventories.

If in the period following the reporting period, the current market value of inventories, against the decrease in the cost of which a reserve was created in the reporting period, increases, then the corresponding part of the reserve is deducted from the cost of material expenses recognized in the period following the reporting period.

The accrual of a reserve for the decrease in the value of inventories is reflected in the accounting records under the account “Other income and expenses”. The accrued reserve is written off to increase financial results (account "Other income and expenses") as the inventory related to it is released.

The materials received by the organization are documented in accounting documents in the following order.

Together with the shipment of products, the supplier sends the buyer settlement and other accompanying documents: a payment request (in two copies: one directly to the buyer, the other through the bank), waybills, a receipt for the railway bill of lading, etc. Settlement and other documents related to the receipt materials are sent to the accounting department, where the correctness of their execution is checked, after which they are transferred to the responsible supply executor.

In the supply department, according to incoming documents, they check the compliance of the volume, assortment, delivery time, prices, quality of materials, and other contractual conditions. As a result of such a check, a note is made on the settlement or other document itself about full or partial acceptance (consent to payment). In addition, the supply department monitors the receipt of goods and their search. To this end, the supply department maintains a Register of Incoming Goods, which indicates the registration number, date of entry, name of the supplier, date and number of the transport document, number, date and amount of the invoice, type of cargo, number and date of the receipt order or act of acceptance of the request about the search for cargo. In the notes, a note is made about the payment of the invoice or the refusal of acceptance.

Verified payment requests from the supply department are transferred to the accounting department, and the receipts of transport organizations are transferred to the forwarder for receiving and delivering materials.

The freight forwarder accepts the arrived materials at the station by the number of places and weight. If he finds signs that cast doubt on the safety of the cargo, he may require the transport organization to check the cargo. In the event of a shortage of places or weight, damage to containers, damage to materials, a commercial act is drawn up, which serves as the basis for filing claims against the transport organization or supplier.

To receive materials from the warehouse of non-resident suppliers, the freight forwarder is issued an order and a power of attorney, which indicate the list of materials to be received. When accepting materials, the freight forwarder makes not only quantitative, but also qualitative acceptance.

The freight forwarder delivers the accepted goods to the warehouse of the enterprise and hands them over to the warehouse manager, who checks the compliance of the quantity and quality of the material with the data of the supplier's invoice. The materials accepted by the storekeeper are issued by receipt orders. The receipt order is signed by the warehouse manager and forwarder.

Material values come in the appropriate units of measurement (weight, volume, linear, numerical). If materials are received in one unit and consumed in another, then they are taken into account simultaneously in two units of measure.

If there are no discrepancies between the supplier's data and the actual data, it is allowed to capitalize materials without issuing a receipt order. In this case, a stamp is affixed to the supplier's document, the prints of which contain the main details of the incoming order. Quantity primary documents while decreasing.

In cases where the quantity and quality of the materials arrived at the warehouse do not correspond to the data of the supplier's invoice, the commission accepts the materials and draws up an act of acceptance of the materials, which serves as the basis for filing a claim with the supplier. The commission must include a representative of the supplier or a representative of a disinterested organization. The act is also drawn up upon acceptance of materials received by the enterprise without a supplier invoice (non-invoiced deliveries).

If materials are transported by road, then the consignment note is used as the primary document, which is drawn up by the consignor in four copies: the first of them serves as the basis for writing off materials from the consignor; the second - for posting materials by the recipient; the third - for settlements with a motor transport organization and is an appendix to the invoice for payment for the transportation of valuables; the fourth is the basis for accounting for transport work and is attached to the waybill. The bill of lading is used as a receipt document for the buyer if there is no discrepancy between the amount of goods received and the invoice data. In the presence of such a discrepancy, the acceptance of materials is formalized by an act of acceptance of materials.

The arrival at the warehouse of materials of own manufacture, production waste, etc., is formalized by single- or multi-line requirements-waybills, which are issued by the delivering shops in two copies: the first is the basis for writing off materials from the delivering shop, the second is sent to the warehouse and used as a receipt document. Materials received from the dismantling and dismantling of buildings and structures are accounted for on the basis of an act on the capitalization of material assets received during the dismantling and dismantling of buildings and structures.

Accountable persons purchase materials in trade organizations, from other organizations and cooperatives, on the collective farm market or from the population for cash. A document confirming the cost of the purchased materials is a commodity invoice or an act (certificate) drawn up by an accountable person, in which he sets out the content of the business transaction, indicating the date, place of purchase, name and quantity of materials and price, as well as data from the passport of the seller of the goods. The act (certificate) is attached to the advance report of the accountable person.

In accordance with the Chart of Accounts, accounting for the receipt of materials and the amounts of transportation and procurement costs is carried out in one of the following ways, which must be indicated in the Accounting Policy of the enterprise:

1) On account 10 “Materials”, two sub-accounts 10 / accounting prices and 10 / TZR are opened to separately reflect the cost of materials at discount prices and the amounts of TZR;

2) Using accounts 15 “Procurement and acquisition of material assets” and account 16 “Deviation in the cost of material assets” to account for the costs of procurement and deviation;

3) Direct inclusion of TZR in the actual cost of materials (with a small range of materials).

The actual cost of all received materials is formed at the end of the month, therefore, the current accounting of the release of materials into production and for other purposes is allowed to be kept at accounting prices. These prices are as follows:

1) Negotiated prices

2) Actual cost of materials

3) Planned and estimated prices

4) Average price of the group.

At the end of the month, deviations in the cost of materials sold at discount prices from their actual cost are calculated by the percentage of deviations.

% deviation =*100%

Amount of TZR =

The calculated amount of TZR is debited monthly to the same accounts where the consumption of materials was reflected at accounting prices.

In practice, the calculation of the TZR is done in a special register "Vedomosti No. 10".

Table 1. Calculation of TZR

Account 15 “Procurement and acquisition of material assets” reflects the receipt of materials at contractual prices, as well as TZR.

At the end of the month, deviations are determined on the 15th account by comparing the debit and credit turnover. Positive deviations are written off from the credit of account 15 to the debit of account 16, negative deviations are written off on the contrary, or a reversal entry is made.

At the end of the month, deviations in cost are debited to the same accounts where materials were debited during the month at accounting prices. Distributions are made according to the same formula of% deviations. Positive deviations are debited from the debit of the 16th account to the credit of the cost accounts (20, 23, 25, 26, 44, 29). Negative variances are reflected in the same entry, but reversed.

Consider an example of purchasing materials for an organization for a fee.

The organization "Boets" LLC purchases 5 mm cartridges in the amount of 35,000 pieces. at a price of 1.77 rubles per piece with VAT. Delivery costs 3540 rubles including VAT, consulting costs 1180 rubles including VAT. We reflect the purchase of cartridges in two ways.

|

Amount, rub. |

|||||

|

Using accounts 10/uch prices and 10/TZR and 15 |

|||||

|

Reflected the purchase of 5 mm cartridges |

10/uch prices (15) |

||||

|

Reflected VAT on purchased cartridges |

|||||

|

Reflected the cost of shipping ammunition |

|||||

|

Reflected VAT on the delivery of cartridges |

|||||

|

Reflected consulting costs |

|||||

|

Reflected VAT on consulting expenses |

|||||

|

Accepted for deduction before the VAT budget |

|||||

|

Paid the supplier's invoice for cartridges, delivery and consultation |

3. Documentation, evaluation and accounting of released material assets for production and for other purposes, reflection of accounting for the movement of material assets in accounting registers

Materials are released from the warehouse of the organization for production consumption, household needs, to the side, for processing and in the order of the sale of surplus and illiquid stocks.

An important condition for the control rational use materials are their rationing and release on the basis of established limits. The limits are calculated by the supply departments on the basis of the data of the planning department on the volume of output and the rates of consumption of materials per unit of output.

All services of the enterprise must have a list of officials who are granted the right to sign documents for the receipt and release of materials from the warehouse, as well as issue permission to export them from the enterprise. Released materials must be accurately weighed, measured and counted.

The procedure for documenting the release of materials depends primarily on the organization of production, the direction of consumption and the frequency of their release.

The consumption of materials released into production and for other needs on a daily basis is drawn up with limit-fence cards. They are issued in two or three copies for one or more types of materials and, as a rule, for a period of one month. Quarterly limit-fence cards with tear-off monthly coupons for actual vacations can be used. They indicate the type of operation, the number of the warehouse issuing materials, the receiving workshop, the code of costs, the item number and name of the materials being dispensed, the unit of measurement and the limit of the monthly consumption of materials, which is calculated in accordance with the production program for the month and the current consumption rates.

One copy of the limit-fence card is handed over to the receiving workshop, the other - to the warehouse. The storekeeper records the amount of released material and the balance of the limit in both copies of the card and signs in the card of the receiving workshop. The representative of the workshop signs for the receipt of materials in the map located in the warehouse.

The limit-fence card can be issued in one copy. In this case, the recipient signs for the receipt of materials directly on the warehouse accounting card, and the person responsible for the release of materials from the warehouse signs on the limit-fence card.

The release of materials from warehouses is carried out within the established limit. Over-limit issue of materials and replacement of one material with another (in the absence of material in the warehouse) is issued by issuing a separate requirement - an invoice for replacement (additional issue of materials). When replacing in the limit-intake card of the replaced material, the entry “Replacement, see requirement No. _” is made and the balance of the limit is reduced. Materials not used in production and returned to the warehouse are recorded in the limit-fence card without drawing up any additional documents.

The use of limit-fence cards significantly reduces the number of one-time documents. The calculation of limits and the issuance of limit-fence cards on modern computers makes it possible to increase the validity of calculated limits and reduce the complexity of compiling maps.

If materials are released from the warehouse infrequently, then their release is issued with single- or multi-line requirements-waybills for the release of materials, which are issued by the receiving workshop in two copies: the first, with the receipt of the storekeeper, remains in the workshop, the second, with the receipt of the recipient - at the storekeeper.

To account for the movement of materials within the enterprise, single-line or multi-line invoice requirements are used. Invoices are made by the financially responsible persons of the site that sells the valuables, in two copies, one of which remains in place with the receipt of the recipient, and the second with the receipt of the person selling the valuables is transferred to the recipient of the valuables.

The release of materials to third-party organizations or farms of their organization located outside it is issued by waybills for the release of materials to the side, which are issued by the supply department, as a rule, in triplicate on the basis of orders, contracts and other documents: the first copy remains in the warehouse and is the basis for analytical and synthetic accounting of materials, the second is transferred to the recipient of the materials, and the third - to the accounting department. If the materials are issued with subsequent payment, then the first copy is also used for issuing settlement and payment documents by the accounting department.

When transporting materials by road, a consignment note is used instead of a consignment note.

The write-off of materials is drawn up by an act for the write-off of materials, which is drawn up by a specially created commission, with the participation of a financially responsible person.

Instead of primary documents for material consumption, you can use material accounting cards. To this end, representatives of the recipient workshops sign for the receipt of materials on the cards themselves, which in this connection become supporting documents. At the same time, the cipher of production costs is affixed to the cards for the purpose of subsequent grouping of records by costing objects and cost items. Such a combination of consumable documents and material accounting cards reduces the amount of accounting work and enhances control over compliance with stock standards.

For the actually used materials, the subdivision-recipient of the materials draws up an expense report, which indicates the name, quantity, discount price and amount for each item, the order code for which the materials were spent, the standard and actual consumption of materials, indicating the identified deviations and their reasons. In necessary cases, the act indicates the quantity of manufactured products or the amount of work performed. In addition, the departments of the organization monthly prepare reports on the availability and movement of material assets and transfer them to the accounting department.

In small organizations, the release of materials for the production of products and the provision of services is carried out without registration special documents. Actually used materials by their types are reflected in acts or reports on the release and sale of finished products. Acts are drawn up, as a rule, ten days by an employee of the enterprise responsible for the acceptance, storage and sale of products. After approval by the head of the organization, the act serves as the basis for writing off the relevant materials.

AT set days documents on the receipt and consumption of materials are handed over to the accounting department of the organization according to the register of acceptance and delivery of documents, drawn up in two copies: the first is handed over to the accounting department against the receipt of the accountant on the second copy, and the second remains in the warehouse.

In accordance with PBU 5/2001, materials released for consumption can be evaluated in one of the following ways, which is indicated in the accounting policy of the enterprise and is applied by group or type of materials:

1) At the cost of each unit;

2) At the average cost;

3) FIFO (the first batch for income and the first for expenditure - at the cost of the first batches by time of receipt).

|

Indicators |

Quantity, kg. |

price, rub. |

Amount, rub. |

||

|

Balance at the beginning of the month |

|||||

|

Received in January: |

|||||

|

Total received per month |

|||||

|

Total received with the remainder |

|||||

|

Released in January: 1. to the main production 2. for sale 3. for other needs |

|||||

|

Total released |

|||||

|

Write-off of materials at average cost Released in January: 1. to the main production 2. for sale 3. for other needs |

513000/31000=16,55 |

||||

|

Write-off of materials using the FIFO method Released in January: 1. to the main production 2. for sale 3. for other needs |

|||||

|

Total expense |

|||||

Consider the continuation of example 1, write off 22500 pieces. cartridges for the needs of the organization of the main production.

Journal of registration of business transactions

Subdivisions of the organization monthly prepare reports on the movement and availability of material assets, which are transferred to the accounting department at the time specified by the schedule. The accounting department is required to:

1) Check the reports received from the unit. Checking the point of view of the legality of the transactions;

2) Reconcile department reports with warehouse documents;

3) Determine, together with other departments, the deviations of the actual consumption of materials from the established norms;

4) Regularly monitor the correctness of accounting for materials in warehouses and in the unit.

The receipt of materials in the organization and settlements with suppliers are reflected on the basis of primary documents in the register, which allows you to control settlements with suppliers. With a journal-order form, this is Journal-Order No. 6.

4. Accounting for material assets in the warehouse and its connection with accounting in accounting

For the storage of inventories in organizations are created:

a) central (basic) warehouses, which are directly administered by the head of the organization or service (department) of supply and marketing. Central warehouses, as a rule, should be specialized, especially in cases where the organization has materials that require different storage modes. For the storage of finished products, as a rule, separate warehouses are created;

b) warehouses (pantries) of shops, branches and other divisions of the organization.

Specially adapted areas are equipped for open storage materials.

In warehouses (pantries), inventories are placed in sections, and inside them - in groups, standard and grade sizes on racks, shelves, cells, in boxes, containers, bags and other containers and in stacks.

The placement of inventories should ensure their proper storage, quick search, release and availability check.

As a rule, a label is attached to the place of storage of inventories, and inscriptions are made on the cells (boxes) (for example, on glued sheets of paper or tags) indicating the name of the material, its distinguishing features (brand, article, size, grade, etc. .), item number, unit of measure and price.

Reception, storage, release and accounting of inventories for each warehouse are assigned to the relevant officials (warehouse manager, storekeeper, etc.), who are responsible for the correct acceptance, release, accounting and safety of the stocks entrusted to them, as well as for the correct and timely registration receiving and dispensing operations. Agreements on full material liability are concluded with the said officials in accordance with the legislation of the Russian Federation.

Accounting for inventories (i.e. materials, containers, goods, fixed assets, finished products, etc.) stored in warehouses (pantries) of the organization and divisions is kept on inventory cards for each name, grade, article, brand , size and other distinguishing features of material values (varietal accounting). When automating accounting work, the above information is formed on magnetic (electronic) media of computer equipment.

Warehouses conduct quantitative and varietal accounting of inventories in the established units of measurement, indicating the price and quantity.

Warehouse accounting cards are opened for a calendar year by the supply service (supply and sales) organization. At the same time, the details provided in the cards are filled in: warehouse number, full name of material assets, grade, article, brand, size, item number, unit of measure, accounting price, year and other details.

A separate card is opened for each item number of the material.

Warehouse accounting cards are registered by the accounting service of the organization in a special register (book), and in case of mechanized processing - on the appropriate machine carrier. When registering on the card, the card number and the visa of an employee of the accounting service or a specialist performing an accounting function in an organization are put on the card.

Cards are issued to the warehouse manager (storekeeper) against receipt in the register.

In the received warehouse accounting cards, the warehouse manager (storekeeper) fills in the details characterizing the places of storage of material assets (rack, shelf, cell, etc.).

Accounting prices of inventories stored in warehouses (in pantries) of the organization and divisions are put down on the organization's warehouse accounting cards.

In cases of change in discount prices, additional records are made on the cards about this, i.e. the new price is indicated and from what time it is valid.

If the organization uses supplier prices or the actual cost of materials as the accounting price:

a) a new warehouse accounting card is opened with each price change;

b) accounting is kept on the same card, regardless of price changes. In this case, the cards on the line "Price" indicate "Supplier price" or "Actual cost". A new price is recorded for each transaction.

If the accounting service records materials according to the balance method, the cards are filled out in the form of a turnover sheet, indicating the price, quantity and amount for each operation for income and expense, the balances are displayed accordingly by quantity and amount. Entries of amounts in the cards, as a rule, are made by an employee of the accounting service. By decision of the head of the organization, on the proposal of the chief accountant, this work may be assigned to the person who keeps records on warehouse accounting cards.

Accounting for the movement of inventories (receipt, consumption, balance) in the warehouse is carried out directly by the materially responsible person. In some cases, it is allowed to assign the maintenance of warehouse accounting cards to operators with the permission of the chief accountant and with the consent of the financially responsible person.

After the card is completely filled out for subsequent records of the movement of inventories, the second sheet of the same card and subsequent sheets are opened. Card sheets are numbered and stitched together.

The second and subsequent sheets of the card are endorsed by an employee of the accounting service during the next check.

When automating (mechanizing) accounting for the movement of material reserves, the forms of accounting documentation specified in this paragraph and the accumulative registers of operational accounting may be presented on magnetic (electronic) media of computer equipment.

On the basis of the in due course and executed primary documents (receipt orders, claims, waybills, waybills, other receipts and expenditure documents), the warehouse manager (storekeeper) makes entries in the warehouse accounting cards indicating the date of the transaction, the name and number of the document and summary operations (from whom it was received, to whom it was released, for what purpose).

In the cards, each operation reflected in a particular primary document is recorded separately. When making several identical (homogeneous) operations on the same day (for several documents), one entry can be made with reflection total according to these documents. In this case, the content of such an entry lists the numbers of all such documents or compiles their register.

Entries in warehouse accounting cards are made on the day of transactions and balances are displayed daily (if there are transactions).

Posting from limit-fence cards to warehouse accounting cards of data on the issue of materials can be carried out as the cards are closed, but no later than the last day of the month.

At the end of the month, the cards display the totals of turnovers for income and expenses and the balance.

Employees of the accounting service of the organization who keep records of inventories are obliged to systematically, within the time limits established by the organization, but at least once a month, directly in the warehouses in the presence of the warehouse manager check the timeliness and correctness of the execution of primary documents for warehouse operations, records of operations in the warehouse cards accounting, as well as the completeness and timeliness of the delivery of executed documents to the accounting service of the organization.

When maintaining the balance method of accounting for materials in the accounting service, the employee of the accounting service checks all entries in the warehouse accounting cards with primary documents and confirms with his signature the correctness of deducing the balances in the cards. Reconciliation of cards with documents and confirmation of operations by the signature of the inspector can also be carried out in cases where the accounting service records materials using turnover sheets.

When maintaining accounting cards in the accounting service of the organization (cards of the accounting service are checked against warehouse cards.

Financially responsible persons are obliged, at the request of the inspector of the accounting service, to present material assets for verification.

Periodically, within the time limits established in the organization by the workflow schedule, warehouse managers are required to hand over, and employees of the accounting service or other division of the organization - to accept from them all primary accounting documents that have passed through the warehouses for the corresponding period.

Acceptance and delivery of primary accounting documents is formalized, as a rule, by compiling a register, on which an employee of the accounting service or other division of the organization signs for receipt of documents.

The delivery of limit-fence cards by the warehouse is made after the use of the limit. At the beginning of the month, all cards for the previous month must be dealt, regardless of the use of the limit. If the limit-fence card was issued for a quarter, it is handed over at the beginning of the next quarter, and at the beginning of the second and third months of the current quarter, monthly coupons from quarterly cards are handed over, if coupons were issued.

Before the delivery of limit-fence cards, their data is verified with shop copies of cards (when cards are maintained in two copies). The reconciliation is confirmed by the signatures of the warehouse manager (storekeeper) and the responsible employee of the organizational unit that received the materials.

At the end of the calendar year, balances are displayed on the warehouse accounting cards as of January 1 of the next year, which are transferred to newly opened cards for the next year, and the cards of the past year are closed, stitched (filed) and handed over to the archive of the organization.

At the direction of the head of the supply service (supply and sales) and the permission of the chief accountant, warehouse accounting cards can be maintained in the next calendar year. In necessary cases, new cards can be closed and opened in the middle of the year.

In warehouses (in pantries), instead of warehouse accounting cards, accounting is allowed in warehouse accounting books.

In the inventory books, a personal account is opened for each item number. Personal accounts are numbered in the same order as the cards. For each personal account, a page (sheet) or the required number of sheets is allocated. In each personal account, the details specified in the warehouse accounting cards are provided and filled in.

At the beginning or at the end of the book there is a table of contents of personal accounts indicating the numbers of personal accounts, the names of material assets with their distinctive features and the number of sheets in the book.

Stock books must be numbered and laced. The number of sheets in the book is certified by the signature of the chief accountant or a person authorized by him, and the seal.

Stock books are registered in the accounting service of the organization, which is recorded in the book indicating the number in the register.

The organization may establish a different procedure for issuing inventory books.

With a small range of materials and small turnovers, it is allowed to keep monthly material reports instead of warehouse accounting cards (books) at all or at individual warehouses (storerooms) of the organization and divisions.

The monthly material report reflects the data (details) that are available in the warehouse accounting cards, the balance of materials at the beginning of the month, income and expenditure for the month and the balance at the end of the month. At the same time, several columns can be assigned to record transactions for income and expense, including for reflecting information about the receipt of materials (from suppliers, from other warehouses and departments of the organization, etc.), vacation (for production departments serving industries and farms , for sale, etc.) and (or) for what purposes.

In monthly material reports, they usually reflect materials for which there was a movement (income or expense) in a given month. In this case, at the beginning of each quarter, a balance sheet is compiled for the entire range of materials of this warehouse (pantry).

The material reports also indicate the amount (in terms of income, expenditure and balances) of material assets. The amount is filled in (taxation) by the accounting service of the organization, or by a specialist performing an accounting function, or by a warehouse manager (storekeeper).

Material reports with the attachment of all primary documents are submitted to the accounting service of the organization within the time limits established by the organization. The list of warehouses (storerooms) where monthly material reports are kept, the form of the report, the procedure for its preparation, submission and verification are determined by the decision of the head of the organization on the recommendation of the chief accountant.

5. Inventory of material assets

To ensure the reliability of accounting data and financial statements, organizations are required to conduct an inventory of stocks, during which their presence, condition and assessment are checked and documented.

The procedure for conducting an inventory is determined by the head of the organization, with the exception of cases where an inventory is mandatory.

An inventory is required:

- when transferring property for rent, redemption, sale, as well as when transforming a state or municipal unitary enterprise;

- before the preparation of annual financial statements (except for property, the inventory of which was carried out no earlier than October 1 of the reporting year). In organizations located in the regions of the Far North and areas equated to them, an inventory of goods and materials is carried out during the period of their least balance;

- when changing financially responsible persons;

- when revealing the facts of theft, abuse or damage to property;

- in case of natural disaster, fire or other emergencies caused by extreme conditions;

- in case of reorganization or liquidation of the organization;

- in other cases stipulated by the legislation of the Russian Federation.

In order to organize current control over the safety of stocks, promptly identify possible discrepancies between accounting data and their actual availability for individual items and (or) groups in places of storage and operation, checks are carried out in organizations.

The procedure for conducting inspections, including the determination of specific names, types, groups of reserves to be checked, the timing of the inspection, etc., is established by the head of the organization, as well as the heads of the organization's divisions on behalf of the head of the organization.

To carry out a set of works to identify the actual availability of stocks, compare the actual availability of stocks with accounting data, document the facts of non-compliance of the quantity, quality, range of incoming stocks with the relevant indicators (characteristics) provided for in contracts (deliveries, sales and other similar documents) , determining the reasons for the write-off of inventories and the possibility of using waste and a number of other similar works, a permanent inventory commission is created in the organization.

Taking into account the large volume of these works, their special nature, working inventory commissions can be created in the organization.

The personal composition of the permanent and working inventory commissions is approved by the head of the organization, about which an administrative document (order, order, etc.) is issued.

The composition of these commissions includes representatives of the administration of the organization, employees of the accounting service, and other specialists.

The composition of the inventory commission may include representatives of the internal audit service of the organization, independent audit organizations.

The accounting service of the organization is obliged:

- to control the timeliness and completeness of the inventory;

- to demand the delivery of inventory materials to the accounting service;

- monitor the timely completion of inventories and documentation of their results;

- reflect on the accounts of accounting discrepancies identified during the inventory between the actual availability of property and accounting data.

According to the results of inventories and inspections, appropriate decisions are made to eliminate shortcomings in the storage and accounting of stocks and to compensate for material damage.

The discrepancies between the actual availability of property and accounting data identified during the inventory are reflected in the following order:

a) surplus inventories are accounted for at market prices and at the same time their value is related to:

- in commercial organizations - on financial results;

b) the amounts of shortages and damage to stocks are debited from the accounting accounts at their actual cost, which includes the contractual (account) price of the stock and the share of transportation and procurement costs related to this stock. The procedure for calculating the specified share is established by the organization independently. In accounting, this operation is reflected in the debit of the account “Shortages and losses from damage to valuables” and the credit of the inventory accounts - in terms of the contractual (record) price of the stock and the debit of the account “Shortages and losses from damage to valuables” and the credit of the account “Deviation in the cost of materials ”, when using in the accounting policy of the organization the accounts for the procurement and purchase of materials or the corresponding sub-account to the inventory accounts in terms of the share of transportation and procurement costs.

In case of spoilage of stocks that can be used in the organization or sold (with a markdown), the latter are simultaneously credited at market prices, taking into account their physical condition, with a decrease in losses from spoilage by this amount.

Lack of stocks and their damage are written off from the account “Shortages and losses from damage to valuables” within the norms of natural loss to the accounts of production costs and/or sales expenses; above the norm - at the expense of the perpetrators. If the perpetrators are not identified or the court refused to recover damages from them, then losses from shortage of stocks and their damage are written off to the financial results of a commercial organization, to an increase in expenses from non-profit organization. Attrition rates can be applied only in cases of actual shortages.

Similar Documents

Features of accounting information systems. Characteristics of accounting automation programs. Requirements for programs for automated accounting of material assets in a warehouse. Carrying out inventory of material assets in the warehouse.

term paper, added 02/21/2011

The concept and classification of material values, the tasks and principles of building their accounting. general characteristics LLC "Terminal", documentary registration and inventory accounting of material assets in the organization, organization of synthetic and analytical accounting.

term paper, added 09/14/2013

The main methods of inventory accounting of inventory items. The procedure for organizing the accounting of material assets in a warehouse on the example of JSC "Firma story +". Document flow for the movement of materials. An example of accounting and valuation of the acquisition of material assets.

term paper, added 07/08/2015

General characteristics of the tasks of accounting for material assets: identifying excess values, reflecting costs. Acquaintance with the peculiarities of the material assets of organizations in the Russian Federation. Analysis of the problems of property accounting.

term paper, added 12/14/2014

Analysis of the reporting of material indicators at the enterprises of Ukraine. Classification of inventory items. Organization of accounting, workflow, evaluation of material assets in LLC "Contact" using ABC analysis. Directions for its improvement.

thesis, added 11/18/2014

Synthetic accounting of material values. Documenting settlements with suppliers and contractors. The procedure for accounting for material values on the example of CJSC "Litmash-NSRZ". Basic rules of workflow and technology for processing accounting information.

term paper, added 01/18/2013

The concept and classification of material values. Features of their evaluation. Accounting for the receipt, disposal of materials and the reserve for the reduction of their value. Inventory of inventories. Disclosure of information about them in the financial statements.

term paper, added 05/28/2015

Accounting for the property of a credit institution. Cost analysis for the production of bank cards. The procedure for conducting an audit of material assets. Documentation of the receipt and departure of inventories, the use of fuels and lubricants.

term paper, added 02/10/2011

Economic entity material values, their classification. Methods of accounting and evaluation of inventories. Rules for the acceptance of materials, documenting their movement. The procedure for the formation of the actual cost of materials.

term paper, added 08/11/2011

The concept, classification, evaluation and main tasks of accounting for inventories, conducting their inventory. Documentation of the receipt and expenditure of material values. Types of accounting for materials in the warehouse and in accounting.

In the 1C ERP system, when accounting for inventory, workwear, special equipment and other household supplies, they are grouped into some common features operation. Groups are identified by "Categories of Operation".

To reflect the business transaction of transfer to operation in 1C ERP, the document "Transfer to operation" is used. In this document, the nomenclature is assigned a category of operation, an inventory number (if necessary), a division, and an individual to whom the nomenclature is transferred.

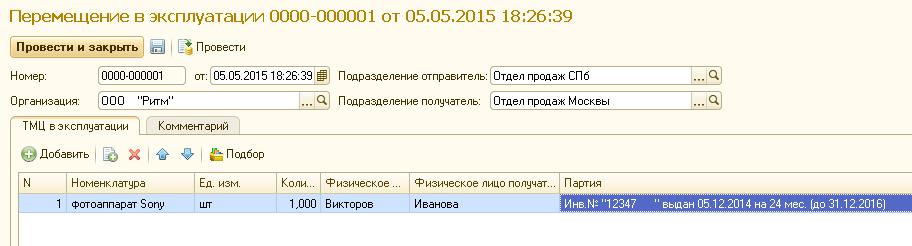

To move material in operation in 1C ERP, the document "Movement in operation" is used.

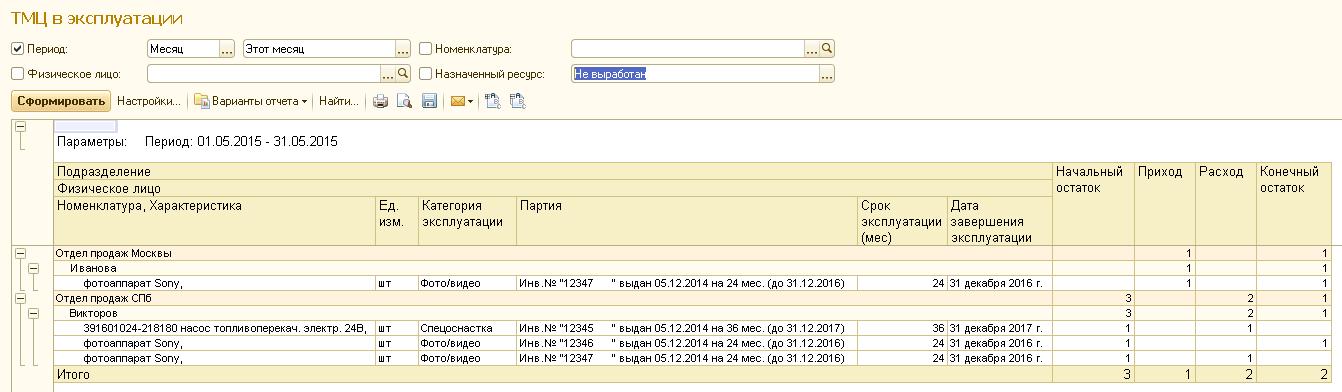

To obtain information about the movement and the final balance of goods and materials in operation in 1C ERP, the report "Inventory and materials in operation" is used.

To write off inventory items that are in operation, 1C ERP uses the document "Decommissioning".

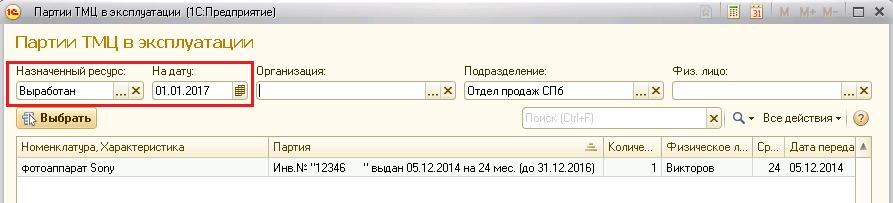

When filling out a document, you can use a filter, in which, in addition to other filter details, there is a service life.

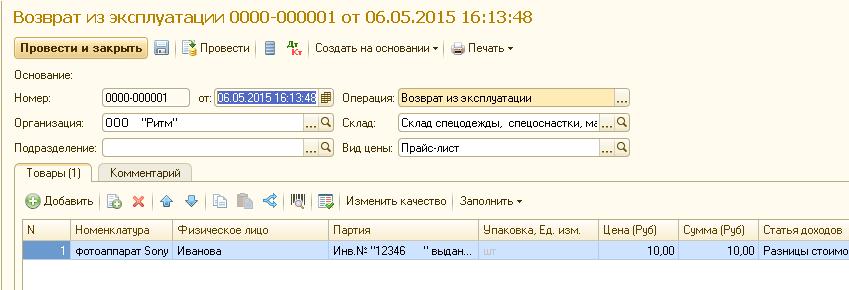

To return from operation to the 1C ERP warehouse, we use the “Return from operation” document.

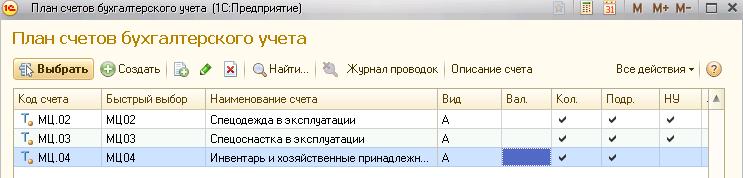

For the purposes of accounting for goods and materials in operation, 1C ERP provides for three sub-accounts of 10 accounts.

Also, there are three off-balance accounts.

Reports for accounting of MPZ in operation

- It is convenient to watch the movement of inventory numbers using accounting report"Account analysis" for accounts MTs.03, MTs.04.

- Balances by inventory numbers and information on inventory in operation can be obtained using the report “Inventory and Materials in Operation.

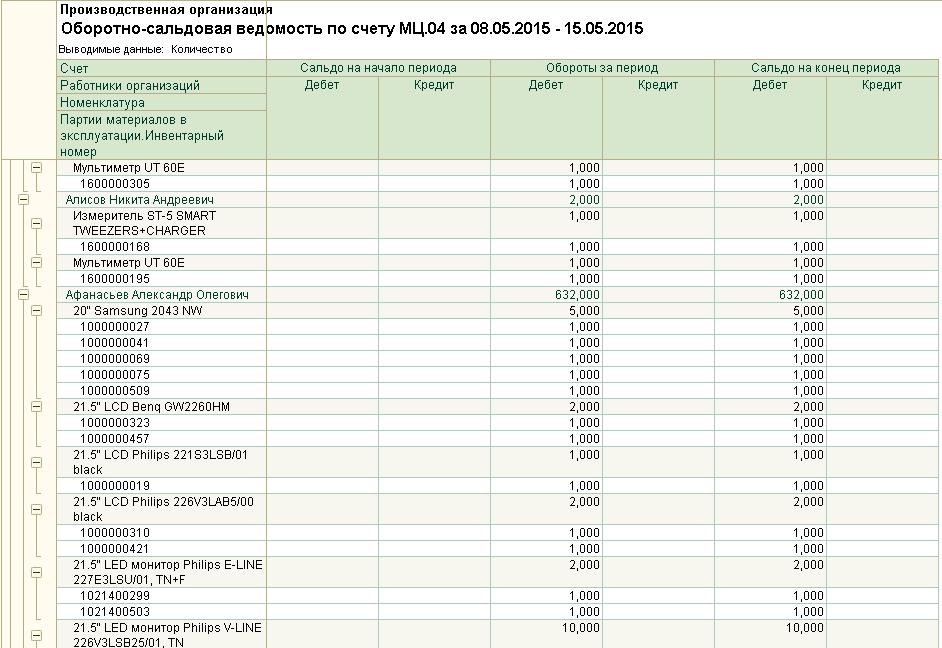

- To obtain information on the balances and turnovers of goods and materials in operation, it is convenient to use the balance sheet on the off-balance account MTs04 (inventory and household supplies). Quantitative and total accounting of goods and materials in operation is kept on this account. The initial cost of goods and materials is used, while on account 10.11.3 - the residual value of goods and materials. The report in 1C ERP can be flexibly adjusted, including the required fields in the enterprise mode.

Turnover balance sheet ERP МЦ.04 by inventory numbers.

- Account MTs.03 (Special equipment in operation) is similar to account MTs.04 with the difference that this account does not contain analytics for the Employees of the organization. It is more suitable for accounting for goods and materials that are not handed out to a specific employee, but are located at the stand. You can also keep records both by inventory numbers and without them. For example, you can put some goods and materials with ID on the stand, and some without them, and see it in one report.

Turnover balance sheet ERP МЦ.03 for additional analytics

Introduction

Inventory management is one of the most important constituent parts production management, consisting in the organization of the conclusion of economic contracts, and in the purchase, delivery and storage of raw materials, materials, components, as well as their accounting and control over their use.

aim term paper is the study of the procedure for evaluating materials, documenting the release of materials for production and economic needs, organizing operational and accounting of the consumption of materials, as well as monitoring the safety and use of them in production.

A detailed study of these issues will identify specific methods for assessing, recording and controlling the material resources used by the organization, as well as suggesting ways to improve the use of materials within the framework of possible accounting methods for material resources recorded in accounting regulations. The cost of production, financial result, taxable profit, the amount of income tax, the amount of value added tax depend on the objectivity and reliability of the information generated in this section of accounting.

The theoretical basis of the course work are the works of modern economists on the issues under study, educational and teaching aids on the accounting of material resources, data from statistical collections, as well as articles from economic periodicals.

The practical basis of this course work is the information of analytical and synthetic accounting of material assets Branch of OJSC "PAVA" SPP Mikhailovsky flour mill Altai Krai Mikhailovsky district.

1 General principles inventories

1.1 The concept, classification and tasks of accounting for materials

The methodological basis for the formation of information on the organization's inventories in accounting is established by the Accounting Regulation "Accounting for inventories" (PBU 5/01), approved by order of the Ministry of Finance of the Russian Federation dated June 9, 2001 No. 44n

The composition of inventories includes: materials, finished products, goods.

Materials are one of the most important elements of the production cycle of any organization; they are objects of labor that are used to manufacture products, perform work, and provide services. Their peculiarity lies in the fact that, participating in the production process, materials are completely consumed in each of its cycles and fully transfer their value to newly created products (works, services).

The classification of materials is convenient to use for building synthetic and analytical accounting, compiling statistical reports, information on the receipt and consumption of materials in the production and economic activities of the organization, to determine the balance.

Finished goods - part of inventories intended for sale, which is end result production process, completed by processing (assembly), the technical and qualitative characteristics of which comply with the terms of the contract or the requirements of documents in cases established by law.

Goods are that part of the organization's inventory that is purchased or received from other legal entities and individuals and is intended for sale without additional processing. [1, 265c.]

In the production process, materials are used in various ways: they can be completely consumed in the production process (raw materials and materials), or change their form (for example, lubricants). Some materials are included in the product without any changes (spare parts), others are not included in the mass at all or chemical composition products, but contribute to its manufacture (wear items).

Inventories, depending on their role in production, are divided into the following types:

- raw materials (products of extractive industries);

- basic materials (materials that form the basis of the product or are a component for its creation);

- fuel;

- purchased semi-finished products and components (items purchased to create and complete the product);

- auxiliary materials (materials that are involved in the manufacture of products and are consumed for technical and economic needs - paints, cleaning materials, etc.);

– Spare parts (parts of equipment to replace worn ones);

- low-value and fast-wearing items;

- containers (items for packaging, transportation and storage of materials and products);

- Other materials.

Inventories are also classified according to technical properties, highlighting ferrous metals, non-ferrous metals, rolled products, chemicals, etc. In the context of these groups, enterprises keep records of receipts, consumption and balances of industrial inventories. [2, 79c. ]

The main tasks of accounting for materials are:

- correct documentation and timely reflection of operations for the receipt, internal movement and disposal of materials;

- providing reliable data on the procurement, receipt and release of materials;

– ensuring the safety and control of the movement and proper use of all material assets;

– compliance with the established norms of stocks and expenses;

- timely identification of unused materials to be sold in the prescribed manner;

- obtaining accurate information about their balances located in the warehouses of the enterprise. [3, 193p.]

1.2 Valuation of material assets

Inventories are accepted for accounting at actual cost. The procedure for the formation of the actual cost of inventories when they are registered depends on the channels for the receipt of material assets.

The actual cost of inventories purchased for a fee is understood as the sum of the organization's actual costs for the acquisition, excluding value added tax and other refundable taxes (except as provided by the legislation of the Russian Federation).

The actual costs for the acquisition of MPZ include:

- amounts paid in accordance with the contract to the supplier;

– amounts paid to organizations for information and consulting services related to the acquisition of inventories;

- customs duties;

– non-refundable taxes paid in connection with the acquisition of a unit of inventory;

- remuneration paid to an intermediary organization through which inventories are acquired;

– costs for the procurement and delivery of inventories to the place of their use, including insurance costs. These costs include, in particular, the cost of procurement and delivery of inventories; costs for the maintenance of the procurement and storage unit of the organization; costs for transport services for the delivery of inventories to the place of their use, if they are not included in the price of inventories established by the contract; accrued interest on loans provided by suppliers (commercial loan); interest on borrowed funds accrued prior to acceptance for accounting of inventories, if the funds are attracted for the acquisition of these inventories;

- the cost of bringing inventories to a state in which they are suitable for use for the planned purposes. These costs include the costs of the organization for processing, sorting, packing and improving the technical characteristics of the received stocks, not related to the production of products, the performance of work and the provision of services;

– other costs directly related to the acquisition of inventories.

The list of costs is open, i.e. provides for the possibility of including in the actual cost of inventories certain costs directly related to their acquisition. General business and other similar expenses are not included in the actual costs of acquiring inventories, except when they are directly related to the acquisition of inventories.

The actual cost of inventories in their manufacture by the organization is determined based on the actual costs associated with the production of these inventories. Accounting and formation of costs for the production of inventories is carried out by the organization in the manner established for determining the cost of production.

The actual cost of inventories contributed as a contribution to the authorized (share) capital of the organization is determined based on their monetary value agreed by the founders (participants), unless otherwise provided by the legislation of the Russian Federation.

The actual cost of inventories received by the organization under a gift agreement (free of charge), as well as those remaining from the disposal of fixed assets and other property, is determined based on their current market value as of the date of acceptance for accounting.

The actual cost of inventories received under contracts providing for the fulfillment of obligations (payment) in non-monetary funds is recognized as the cost of assets transferred or to be transferred by the organization.

The value of assets transferred or to be transferred by an entity in exchange for other property is determined by reference to the price at which, in comparable circumstances, the entity would normally measure the value of similar assets.

Transportation and other costs associated with the exchange are added to the cost of the received stocks directly or are preliminarily included in the composition of transportation and procurement costs, unless otherwise provided by the legislation of the Russian Federation.

The actual cost of inventories, regardless of the methods of their receipt, also includes the actual costs of the organization for their delivery and bringing them into a condition suitable for use.

An organization engaged in trading activities may include the costs of procurement and delivery of goods to central warehouses (bases), incurred before they are transferred for sale, to be included in the cost of sale.

Goods purchased by an entity for sale are valued at their acquisition cost. An organization engaged in retail trade is allowed to evaluate the purchased goods at the selling price with a separate allowance for markups (discounts).

Inventory reserves that do not belong to this organization, but are in its use or disposal, are taken into account on off-balance accounts in the assessment provided for in the contract, or in the assessment agreed with their owner. In the absence of a price for these reserves in the contract or a price agreed with the owner, they may be taken into account at a conditional valuation.

Inventory belonging to the organization, but on the way or transferred to the buyer on bail, are taken into account in accounting in the assessment provided for in the contract, with subsequent clarification of the actual cost.

The actual cost of inventories, in which they are accepted for accounting, is not subject to change, except in cases established by the legislation of the Russian Federation.

Inventory, the value of which is expressed in a foreign currency, when accepted for accounting, is made in rubles, taking into account the exchange rate of the Central Bank of the Russian Federation, effective on the date of acceptance of the inventory data for accounting.

Regulatory documents allow the use of accounting prices in analytical accounting and storage of materials.

As accounting prices for materials, the following can be used:

- negotiable prices. In this case, other costs included in the actual cost of materials are accounted for separately as part of transportation and procurement costs;

- the actual cost of materials according to the previous month or reporting period (reporting year). In this case, the deviations between the actual cost of materials of the current month and their accounting price

noah are taken into account in the composition of transport and procurement costs;

- planned and estimated prices. In this case, deviations of contract prices from planned and estimated prices are taken into account as part of transportation and procurement costs. They are intended for use within an organization. Planning prices are developed and approved by the organization in relation to the level of the actual cost of the relevant materials;

- the average price of the group. In this case, the difference between the actual cost of materials and average price group is taken into account in the composition of transportation and procurement costs.

When materials are released into production and otherwise disposed of, their assessment is carried out by the organization using one of the following methods:

- at the cost of each unit;

- at the average cost;

- at the cost of the first in time acquisition of materials (FIFO method);

- at the cost of the latest acquisition of materials (LIFO method)

The organization can use different methods of valuation of materials when they are released into production for different groups (types) of materials, but for a particular type (group) of materials during the reporting year, only one of the above valuation methods can be used. The use of any of the listed methods by group (type) of materials should be reflected in the accounting policy of the organization based on the assumption of the sequence in which the accounting policy is applied.

At the cost of each unit, materials used by the organization in a special order ( precious metals, gems, radioactive substances, etc.). When issuing materials at the cost of each unit, two options for calculating the cost of a stock unit can be used:

– including all costs associated with the acquisition of stock;

– including only the cost of inventory at the contract price (simplified version).

In the financial statements of the organization, inventories at the end of the reporting year are reflected at a cost determined on the basis of the methods used for estimating reserves. Inventories for which during the reporting year there was a decrease in market value or they partially lost their original quality are reflected in the balance sheet at the current market value. This decrease is reflected in the method of accruing a reserve for the decrease in the value of material assets. The reserve is formed at the expense of the financial results of the organization in the amount of the difference between the current market value and the actual cost of inventories, if the latter is higher than the current market value. This reserve for the decrease in the value of material assets is created for each unit of inventory accepted in accounting. It is allowed to create reserves for depreciation of material assets for certain types (groups) of similar or related inventories. It is not allowed to create reserves for depreciation of material assets for such enlarged groups (types) of inventories as basic materials, auxiliary materials, finished products, goods, etc. The calculation of the current market value of the inventory is made by the organization on the basis of information available before the date of signing the financial statements. The organization must provide confirmation of the current market value of inventories.

Accounting for information on reserves for depreciation of inventories is organized on passive account 14 “Reserves for depreciation of material assets”.

The formation of a reserve is reflected in the accounting on the credit of account 14 “Reserves for the depreciation of material assets” and the debit of account 91 “Other expenses”. In the next reporting period, as the write-off of material assets for which the reserve is formed, the reserved amount is restored: an entry is made in the accounting on the debit of account 14 “Reserves for the depreciation of material assets” and the credit of account 91 “Other income and expenses”. A similar entry is made when the market value of material assets increases, for which the corresponding reserves were previously created.

Analytical accounting on account 14 “Reserves for the depreciation of material assets” is kept for each reserve. [4, 139-148s.]

2 Organization of material accounting

2.1 Documenting the movement of goods

Operations on the movement of material assets, all legal entities, regardless of the form of ownership, must be drawn up with unified primary documents for accounting materials developed by the State Statistics Committee of Russia. Primary documents for the receipt and release of materials must be correctly executed, have the appropriate signatures and be numbered in advance.

We list the documents on accounting for inventories.

Power of attorney (f. No. M-2 and No. M-2a) - is used to formalize the right of an official to act as a trustee of the organization upon receipt of material assets from the supplier. The power of attorney is drawn up in one copy by the accounting department of the organization and issued against receipt to the recipient. The validity period of powers of attorney, as a rule, cannot exceed 15 days; in exceptional cases, it may be issued for a calendar month.

Receipt order (f. No. M-4) - used to account for materials received from suppliers or from processing. A receipt order is drawn up in one copy by a financially responsible person on the day the valuables arrive at the warehouse. It is issued for the actually accepted amount of values. Forms of credit orders are handed over to financially responsible persons in a pre-numbered form.

The act of acceptance of materials (form No. M-7) is used to formalize the acceptance of material assets in cases where there are quantitative and qualitative discrepancies with the data of the supplier's accompanying documents, as well as when accepting stocks received without documents (for uninvoiced deliveries). The act is a legal basis for filing a claim with the supplier; it is drawn up in two copies by members of the acceptance committee with the obligatory participation of a financially responsible person and a representative of the supplier or a representative of a disinterested organization. The act is approved by the head of the organization or other authorized person. One copy of the act with the attached primary documents is transferred to the accounting department to account for the movement of material assets, the other to the supply department or accounting department to send a claim letter to the supplier.

Limit-fence card (f No. M-8) - is needed to account for the release from the warehouse of raw materials, materials, purchased semi-finished products, etc. to the production units of the organization within the approved limit. The vacation limit is determined on the basis of existing standards by calculation, based on the volume of production tasks of the shops, taking into account carry-over inventory balances at the beginning of the reporting period. Limit-fence cards are issued in two copies for a period of one month, and for small volumes - for a quarter. One copy of the card before the beginning of the month is transferred to the structural unit - the consumer of materials, the other - to the warehouse.

Materials are released into production by the warehouse only upon presentation by a representative of the structural unit of his copy of the limit-fence card. The storekeeper notes in both copies the date and quantity of the released materials, after which he displays the rest of the material limit. In the limit-fence card of the structural unit, the storekeeper signs, and in the limit-fence card of the warehouse - the representative of the structural unit. The warehouse delivers limit-fence cards to the accounting department after using the limit.

The requirement-invoice (f. No. M-11) is used to record the movement of material assets within the organization, their release to branches located outside it, and when selling stocks. The waybill is drawn up in two copies by the financially responsible persons of the warehouse or workshop that delivers the valuables. The first copy is intended for write-off of valuables (warehouse, shop), the second - for capitalization of valuables by the receiving party (warehouse, shop). Overlimit release of materials from the warehouse can be carried out only with the permission of the head or chief engineer and is issued by the requirement-invoice (f. No. M-11). Replacing some types of materials with others similar in their properties is also allowed only with the permission of the head and is drawn up with a requirement-invoice of the specified form. This document, together with the limit card of the replaced material, is transferred to the warehouse, and the storekeeper reduces the balance of the limit, taking into account the issuance of substitute materials.

Invoice for the release of materials to the party (f. No. M-15) is used to account for the release of material assets to third parties on the basis of contracts and other documents. The invoice is issued in two copies upon presentation by the recipient of a power of attorney to receive valuables, filled in in the prescribed manner. The first copy is transferred to the warehouse as a basis for the release of materials, the second - to the recipient.

When dispensing materials by self-delivery or removal, the storekeeper sends an invoice signed by the recipient to the accounting department for issuing settlement and payment documents, if the materials were dispensed with subsequent payment.